Technology and Innovation in Retail

TECHNOLOGY &

INNOVATION IN RETAIL

Who’s really ahead?

Luxury v Mid-Market

Contents

04. Part I: Technology & innovation in retail: Who’s really ahead?

04. Technology & innovation in retail

07. Luxury v Mi-Market: Comparative perceptions

23. Part III: Technology & innovation in the future

23. What does this mean for retail in the future?

24. What do retailers need to keep in mind? Luxury and mid-market

Methodology

In Q1 of 2017 WBR Digital surveyed 100 senior decision makers at major consumer brands in Europe. The research focused on luxury and mid-market brands in a range of industries including: fashion, cosmetics and perfumes, automotive and electronics, watches and jewellery.

Participants in the research were split equally between Europe’s major eCommerce markets: the UK, Germany, France, Italy and the Nordics. Our respondents held job titles including: CEO, MD, Director of eCommerce, Head of Marketing and Director of Omnichannel, as well as others of equal standing.

All interviews were conducted by appointment over the telephone. The results were compiled and anonymised by WBR Digital and are presented here with analysis and commentary by Worldpay.

In our analysis, we refer to “luxury” retailers and to “mid-market” or “fast fashion” merchants. Participants selected the label which most accurately represents their business type. The terms “mid-market” and “fast fashion” are used interchangeably to mean the same group: those who do not identify as a luxury brand, but who also do not identify as a budget retailer.

About the contributor

With an intuitive understanding for the difficulties merchants face in this new world of retail, Fiona Wijngaards brings her expertise to Worldpay, acting as Payments Consultant in the EMEA region.

Drawing on a background in consultancy, for the past 9 years Fiona has worked to improve the payment operations for top-tier merchants. Her specialities include managing complex payment integrations for global luxury and multibrand retailers and advising on regulatory changes and trends in the market.

Fiona has broad experience of providing service to corporate customers in the commerce ecosystem and an excellent knowledge of the specific mechanisms involved in payment processing for the retail sector.

Introduction

Brands of all types now realise that creating a cutting-edge eCommerce presence is a not a “nice to have”, it’s a necessity.

But the form that presence takes and the commercial imperatives driving its development vary significantly, depending on the identity of the brand itself.

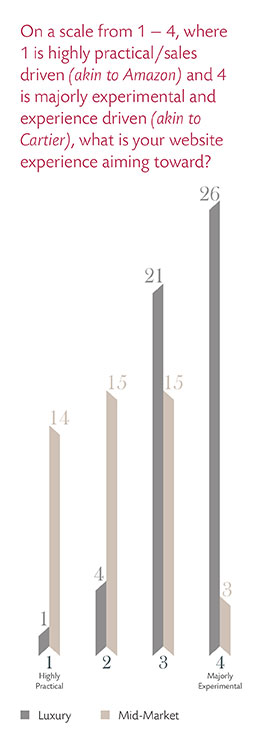

Our research shows luxury brands see implicit value in being ahead of the pack, being seen as innovative, as visionary, and as offering a high-end experience. This is so important for luxury brands that as many as 90% of the luxury retailers we spoke to saw themselves as majorly experimental and experience-driven with regard to their online presence.

Where luxury lead, the mid-market are fine to trail – 82% of mid-market retailers see themselves as followers. So when it comes to cutting-edge online technology, the trend is for innovation to trickle down.

From this it’s clear that mid-market brands are less concerned with being perceived as innovators, or experience-driven. For them it’s about finding ways to increase sale volume and to beat their competitors by being more convenient, more trustworthy and by providing more timely personalised offers. For the mid-market, innovation is about maintaining their brand image and keeping up with the times, rather than being ahead of them.

This mentality isn’t dissimilar from the way the fashion permeates commerce: the top fashion houses use what comes naturally to them – creativity and experimentation – to design and display their lines on the runway. Take a look at the fast fashion store eight months later and you’ll find a variation of that line on their mannequins – made more affordably, in bulk and ready for mass consumption.

Couture isn’t for the masses, it’s for the connoisseur, and so are some of the true tech and innovation displays coming from the same brands.

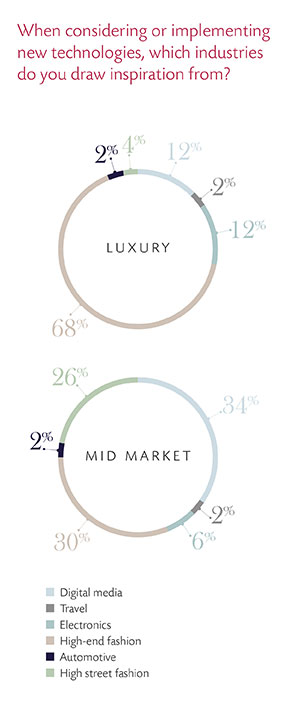

High-end fashion is the motor for inspiration when mid-market retailers look to implement new technology.

90% of Luxury retailers believe they are majorly experimental and experience driven.

69% of Luxury retailers look to high-end fashion for inspiration when considering or implementing new technologies.

82% of Fast Fashion retailers see themselves as followers.

60% of Fast Fashion retailers only believe innovation helps to maintain their brands success.

Industry key findings

Selling Fashion

82% of Luxury retailers see their retail business as innovative.

69% of Fast Fashion retailers see their retail business as followers.

Cosmetics & Perfume

Luxury retailers primarily use personalisation for products.

Mid-Market retailers primarily use personalisation for offers.

Electronics & Automotive

For Luxury retailers, ensuring a seamless payments experience is key — and they endeavour to employ the latest technologies to achieve this.

For Mid-Market retailers, all interviewees state that the shopping experience is laid out in stages with adding products to a basket.

Watches & Jewellery

Luxury retailers are using loyalty programs to personalise their product offering.

Fast Fashion are using offers and discounts.

Technology & innovation in luxury retail

It’s clear from our research that luxury Brands are leading the way in implementing progressive technology and placing priority on innovation.

This is set to have a huge effect on the industry, jolting the growth of online sales by 50% in the next four years and the percentage of overall retail sales from 3% in 2006 to 10% in 2021.

But how are brands actually using technology and innovation, and where will it take the rest of retail?

We’re seeing the most innovation from luxury brands in three main areas: Imagining new ways of bringing the digital to life both at home and in-store, the insurgence of virtual (VR) and augmented (AR) technology and using data to enhance the exclusive experience of traditional luxury shopping.

Digital Transformation

It’s long been said that the luxury sector has been last to the gate when it comes to seeing the true value of eCommerce, with many brands even choosing to shun the digital sphere altogether, fearing a watering down of brand and values.

However, with the long strides of brands like Burberry, Richemont and LVMH, luxury brands are now going beyond the often simplistic views about eCommerce of fast fashion retailers, seeing the channel as a medium instead, and offering the same exclusivity online as instore.

Burberry led the luxury fashion sector’s digital transformation back in 2009 with “The Art of the Trench”, which asked customers to send in snaps of them wearing the iconic trench coat.

Burberry chose the best and used the images for engagement on social media and their website. It resulted in a massive 50% rise in eCommerce sales that year and paved the way for other luxury brands to see the value in not only the digital experience, but the ambassadorship of customers outside of the celebrity and fashion upper echelons.

Now implementing a digital presence — both as a brand website with social media and in-store, with unique digital opportunities for shoppers — is not just something luxury brands are being dragged into. Even the most reluctant have switched gears to begin their own digital revolutions; for example, Céline, one of the originally most staunch opponents to digital, has announced work on their own eCommerce platform.

Whether it’s in tactics such as live-streaming fashion shows like Burberry, creating immersive, experiential sites like Cartier or taking social media to heart and seeing the value in the new face of fashion bloggers, like Swarovski’s #SwarovskiLook and Hugo Boss’ #MasterTheLight campaigns, digitisation of luxury fashion takes its value beyond the checkout.

Virtual & Augmented Reality

While 92% of luxury sales today still take place in physical stores, according to a report by Bain & Company, luxury brands have started pushing beyond luxe interiors and simply letting the fashion speak for itself on the hanger.

Keeping in line with the spirit of creativity and innovation which runs through the industry, luxury brands increasingly look to emerging technologies like virtual reality (VR) and augmented reality (AR) to improve the customer experience in-store.

The cosmetics and beauty industry have really led the way in practical in-store implementation of AR technology with tools like magic mirrors, face mapping and body tracking. The automotive industry is also well-placed to use technology in their showrooms or online, as Porsche does with its AR app.

Now more traditionally-minded brands are taking the gauntlet and discovering creative uses for VR and AR to appeal to the younger generation’s fascination with all things connected.

“92% of luxury sales today still take place in physical stores”

Bain & Company

Recently Dior created its own VR headset, “Dior Eyes”, which gives wearers the feeling of being backstage at a Dior fashion show, with all the sights and sounds. As personal VR headsets become more commonplace, development of in-store wearable technology will set the scene for an at-home experiences of both the store and the brand.

Developing and using VR and AR technologies not only allows customers to become more intimately involved with the product or brand, but it also serves a more integral purpose to the retailer — gathering deeper information for insight into customer preferences.

It further enables a streamlined approach to complete a sale. From trying an item on in a magic mirror, to finding the right colour (even if it’s not in-store), to, as Alibaba has recently released, allowing shoppers to purchase the virtual garment with the nod of a head, VR and AR technologies create a seamless and personal omnichannel purchase journey for shoppers.

Intelligent Data

Digital and virtual channels both make robust data even more accessible, which can in turn be used to further personalise the shopper experience. The luxury shopping experience is all about the personal attention a customer receives in-store, and with the help of data, brands are able to take this relationship one step further.

One excellent example of how online and in-store can finally merge into one seamless experience is FarFetch’s “Store of the Future” concept, which was recently unveiled and tries to aims to humanise the in-store experience for shoppers.

FarFetch’s “Store of the Future” concept aims to humanise the in-store experience for shoppers.

By creating “in-store cookies”, FarFetch enhance personalisation to make the shopper’s experience tailored to their specific interests and styles. This also improves the effectiveness of sales staff, or as they’re calling them: “in-store influencers”. Another method employed is “visual listening”, which uses algorithms to better understand what consumers are saying about a brand by reviewing photos and media on social platforms. By understanding this information, brands can develop further lines with the customer in mind and better market the products that are already available.

Brands which are paying close attention to how and where they can collate and make sense of data are at the front of the pack when it comes to true omnichannel experiences for customers. They’re eliminating the feeling of a “journey to the checkout”, and are instead creating an experience anywhere in the world for their shoppers to experience their brand without ever stepping out to exchange payment.

It’s been said that the best retailers don’t differentiate between in-store and online. And luxury brands are realising that embracing digital doesn’t mean diluting the exclusivity of their label.

Rather than shifting masses of merchandise like many fast fashion retailers, luxury brands are able to curate their services to make a more personalised experience for the loyal brand enthusiast.

Embracing technology allows them to shift from mass generalisations about their audience to individual customer’s views with data to back up true personalisation.

Luxury v Fast Fashion Comparative perceptions

What makes a luxury item desirable? What is so luxurious about luxuries? It’s true that the cost, the quality and rarity of an item may have a bearing, but ask a marketer in the industry and you’ll discover that the real currency of luxury is perception.

The perception of a luxury brand is everything and for the luxury retailers at the top of their game, this highend mentality extends to everything they do, from product design and packaging to tailor-made stores and the technology they use inside them.

Our research demonstrates this, with nearly 9 out of 10 luxury retailers seeing themselves as innovators in the retail space, compared with only 3 in 10 in the midmarket.

In fact, mid-market retailers were happy to label themselves as followers, giving heed to the theory that all fashion innovation stems from the high-end and grows toward the every day.

It’s unanimous: Luxury leads

Here we see direct evidence of the objective split between luxury and fast fashion brands.

Just like on the catwalk, luxury fashion brands are happy to experiment in order to create a memorable experience which enhances the brand image.

On the other hand, fast fashion retailers are focused on selling volume, and seek simply to make their websites clear and convenient for their customers.

As a result of this it should be no surprise that both sides of the aisle agree that luxury brands lead the way with innovation.

For them innovation is the key to success, as it places them at the very apex of performance in the eyes of the consumer. Fast fashion retailers are happy to keep up with the times, but innovation to them is mostly a means of maintaining their brand image.

This general attitude also applies to the way these different groups of retailers employ online technology. Luxury fashion retailers are adaptable to the changing landscape and seek to lead the market in their use of online technology.

Fast fashion retailers, while still keeping an adaptable mindset, are mostly focused on keeping abreast of the technology which is most relevant to their sales strategy.

But why follow?

The top fashion houses in the world have always been seen as innovative. Whether in their seasonal lines, their business models or the way they hire, bringing in new, fresh talent throughout to stay creative.

This mentality permeates the luxury industry, and can be seen as a top priority for them when considering how to best maintain their brand. In fact, we’ve found 46% of luxury retailers we surveyed said innovation is key to their success.

Mid-market or fast fashion retailers take a different stance, with only 18% saying innovation is key. Where the primary driver of a sale is not customer perception, but price, the focus for the business’s eCommerce presence is far more practical.

Building a straightforward, sales-driven eCommerce platform is the key to success for a mid-market retailer whose goal is quite simply to sell more than their competition.

The luxury retailer, however, is selling a lifestyle, and they seek to accentuate their aspirational message with experimental and experience-driven online stores.

So, while luxury retailers lead on innovation and maintain the mystique around their brand, mid-market retailers observe what the industry leaders are doing, evaluate what would work best for them in a sales environment driven by volume, and then capitalise on it to make sure they don’t lose out.

Adaptability in retail

One of the reasons luxury leads in the implementation of new technologies and innovative concepts is their agility in the face of change.

62% of luxury merchants said their brand is adaptable to change in retail and lead the way in innovation, with the rest saying they’re at least experimenting to stay on top of change.

Contrast this with the fast fashion segment, of whom nearly a quarter admit they are reactive rather than adaptable.

When looking to others for where and how to use technology or innovation, luxury brands tend to keep it in the family. This is due to continued consolidation in the industry, and in their unique perspective both on how they want to position their brand and regarding which shoppers to target.

Fast fashion retailers, on the other hand, tend to be more open. They look to not only other brands, but also other industries to see what unique and profitable strides have been made elsewhere.

This way they’re able to take a wider view of what trends work with consumers while also monitoring what would be most financially and technically advantageous.

Who’s the model?

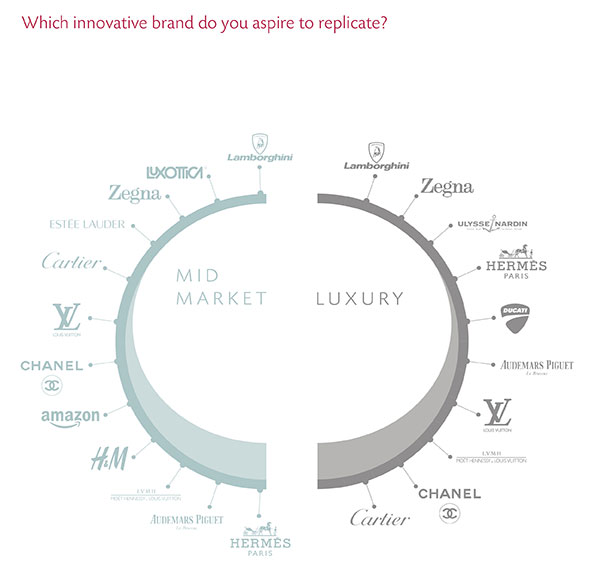

In asking retailers which brands they see as innovative, and of those, which do they aspire to replicate with their own technology implementation or innovation, we’ve found a clear trend on both sides of our survey base.

The diagram to the right not only lists the companies named, but also weighs the number of times they were mentioned.

As expected from previous responses, we see that luxury brands are largely self-referential when it comes to their sources for inspiration and that fast fashion merchants pulled from high-end brands, as well as a couple like-retailers.

However, it was compelling that very similar names cropped up from both sides of the industry in mass, with both sides of the spectrum heavily inspired by names like Audemars Piguet, LVMH and Chanel.

This is a ringing endorsement of these brands, and indicates that they are regarded by their contemporaries as some of the most innovative players in the market today.

Fashion apparel

Ralph Lauren famously said ‘I don’t design clothes, I design dreams’, and so is it with high-end fashion in retail.

Fashion brands see themselves as leaders at a greater rate than retailers in general – 8 out of 10. Fast fashion contemporaries on the other hand regard themselves as dedicated followers, with 7 of 10 identifying themselves as such. And everyone seems to be looking to luxury as leaders, whether luxury brands themselves or in fast fashion.

Of all the industries surveyed, fashion had the strongest push toward innovation and interest in technology. This can already be seen in their marketing, stores and online presence.

From live streaming catwalks, to magic mirrors, to VR store experiences, fashion leads the leaders in technology uptake and innovative vigour.

Why evolve?

Being the most inclined of all industries surveyed to place importance on clever technological implementation and a lean toward an innovative outlook, luxury apparel brands have a compelling reason to do so.

Traditionally concerned with the brand above all else, luxury apparel retailers see tech and innovation as a means to preserve this heritage while growing with their consumer base.

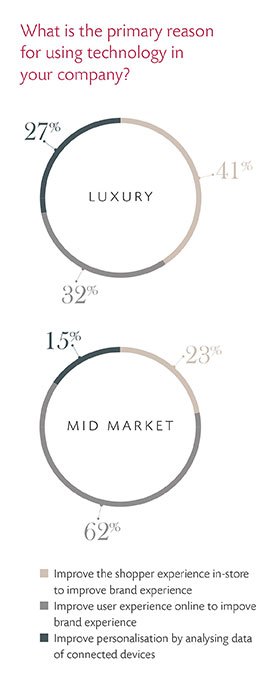

The high-end retailers want to improve the shopping experience in-store, which is the perfect arena to craft an alluring assault to the senses. However, fast fashion brands are more focused online, a more effective vehicle for the mid-tier retailer to push volume. In their use of technology both high-end and fast fashion are concerned with improving their brand experience.

And as both types of retailers are being faced with an increasingly experientially-minded consumer base, implementing the right concepts can mean success or failure as this trend continues.

Luxury put user or brand experience above all else – with 82% saying innovation is a top priority for that reason. Contrast this with the fast fashion response – only 31%, and it’s apparent the priority is elsewhere.

The emphasis on this experience is also evidenced in the methods used by luxury retailers in personalisation, with loyalty programs and product personalisation at the top of their priority list.

For those who base their success on quantity of sales, an effective method is to personalise offers – smart technology which matches offers to customer need can be a decisive factor in closing the sale online.

These personalised offers, however, are far less important for the high-end fashion retailer, who would rather personalise the product in the form of custom fitting or personal monograms.

Luxury merchants are interested more in curating an enjoyment of the brand on a personal, exclusive level, rather than incentivising bulk buys and merchandise shifting.

And when we take a look at where both sets of merchants are getting their ideas – these overall preferences become contextualised. As luxury brands are primarily looking to their own for inspiration, many of their tactics and priorities resemble one another.

Where fast fashion is concerned, looking at the wider commerce network gives them better ideas for what works and what doesn’t. Allowing them to use tried and true methods, even if it’s not in retail, to ensure maximum sale.

Customer experience

Payment is integral to the customer experience for both groups; however, the experiential or transactional purpose for each informs the kind of payment process the retailer creates.

For luxury merchants, it’s all about the brand experience. Therefore, the buying process is seamless, eliminating customer thoughts of a checkout altogether.

For fast fashion merchants, the transactional nature of the site means a multi-stage buying process, encouraging up-sell, profile creation for return buys and emphasising security.

Intelligent data is also integral to the evolving strategies of both luxury and fast fashion brands, enabling them to interact with customers even outside the traditional buying process, or to bring an omnichannel buying experience to both the in-store shopper and their online counterparts.

For luxury this is particularly toned – aiming to give shoppers a taste of the product and brand outside of the store and to ultimately lure them through the doors.

Cosmetics & Perfume

Innovation in cosmetics and perfume can be found across the board; even more so than in some of the other industries our research focused on.

Both luxury and mid-market cosmetics and perfume retailers consider themselves to be innovators in the retail space. However, luxury brands see themselves as truly leading – with 82% claiming to be trailblazing.

Both business types consider innovation to be a top priority for improving the brand experience online, but luxury clearly feels more comfortable forging ahead, while mid-market watches, learns and follows.

Cosmetics & perfume retailers are at the forefront of technology

The traditional struggle for these merchants lies in how to market something that’s so personal –makeup– or is only experienced –perfume– with standard methods of visual marketing in magazines, TV or store display.

With technologies such as AR or VR, these struggles actually become assets. They’re rife for innovation, and these merchants are succeeding.

Comparing the reasons for implementing technology with those of fashion brands, cosmetics and perfume merchants place a higher priority on the online experience and personalisation on connected devices than in-store.

These retailers need to lure customers into the store for them to truly experience it; so effort made online and with connected devices will use experiential and seductive means to drive this.

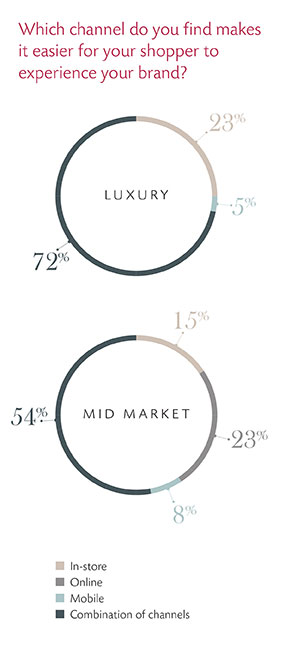

When it comes to where customers experience their brands, more varied answers were given by luxury cosmetics and perfume merchants than in fashion – and, surprisingly, 5% fewer saw in-store as the channel which is easiest for shoppers to experience their brand.

Their mid-market counterparts, however, take this even further – with almost a third of these retailers saying mobile is the easiest channel for customers to experience their brand.

Personalisation is paramount

Personalisation appears to be in play for both luxury and mid-market cosmetics and perfume brands; however, for luxury retailers, an emphasis on loyalty programs, product personalisation and surprise gifts shows a clear push toward creating a unique brand experience, rather than shifting quantity.

Mid-market cosmetics and perfume merchants are also heavily implementing loyalty programs, but are additionally focusing on offers and direct mail. These combine to create a “spread the message” mentality for new buyers and encouraging repeat buyers through gamification in loyalty programs, rather than trying to maintain a solid base, as luxury do.

With regard to their technology muses, luxry cosmetics and perfume brands primarily look to their peers, with a wider spread for the remaining areas of inspiration across digital media, electronics and – at the bottom of this pack – mid-market fashion.

On the other hand, 7 in 10 Mid-market brands are primarily looking to digital media for a boost, with the remainder looking to their mid-market peers to see what technologies are working.

This hints at a reluctance to spend on potentially expensive technology, or a feeling that those innovative tech breakthroughs for the luxury market may not apply to their business objectives.

Automotive Electronics

Though many of their responses correspond to those of the industries discussed, the electronic and automotive industries did have a few stand-out discoveries.

With regard to luxury automotive brands, the peculiarities of selling a high-value item like a car has an effect on the way the brand experience needs to be communicated. Luxury brands place priority on using technology in-store to improve their customers’ brand experience, integrating the exploration of the actual vehicle with technologies like VR to create the experience of being on the road in chic locations in places where such a test drive might not be available.

Contrast this with the overwhelming preference for mid-market automotive brands for using technology to improve user experience online, and we can see a clear division in not only priorities, but capabilities.

Luxury brands will have showrooms to reflect the luxe and chic brand image, while mid-market automotive brands will rely on bringing the brand to the mass audience through a more marketing oriented means.

We’ve also found mid-market focus on convenience and price, tailoring offers to the data they have about their customer. For the luxury brands it’s all about customising the product itself, creating a one-of-akind experience and helping you to stand out from the crowd. You only need to look to the Ferrari tailor-made program, or Q by Aston Martin to see examples of this.

The electronics industry is clearly defined

This industry was the most unanimous of any industry surveyed – with all merchants on each side of the divide saying the same as their peers.

With regard to innovation, 100% of our luxury electronics brands saw themselves as innovative, whereas 100% of mid-market brands saw themselves as followers.

All of our luxury brands have made efforts to integrate the payments portion of the customer journey into the shopping experience by using emerging technologies, but in electronics, not one brand stepped out of this way of thinking.

In contrast, every mid-market merchant has kept the shopping experience segmented by stages, focusing on demographic concerns like security for what are typically bigger buys, even at the mid-market level.

Our research also discovered a consolidation of areas of inspiration for this industry. Both sides of our brands named high-end fashion – over a third for both luxury and mid-market merchants – and electronics as their reference points, but 1 in 3 mid-market brands also cited digital media as influential.

So for an industry with a clear vision, each plays follow the leader, with luxury brands carrying the flag.

Watches

Jewellery

While many of the survey responses for those within the watches and jewellery industry corresponded solidly to those of other segments, a few trends within this base stood out.

Personalisation is key for luxury watch and jewellery brands. So important that when asked which of a set of personalisation options they use, luxury brands selected most. The percentages of each type of personalisation are significantly higher than those of mid-market, pointing to a predilection for personalisation as a means of enhancing the luxury experience.

Mid-market brands tended to select a few key areas of personalisation, loyalty programs and special events in particular. This makes the case that mid-market watch and jewellery brands are leaning toward volume and repeat buys through offering incentives to come back with their loyalty programs and offers.

Another are of note was in how both luxury and mid-market retailers captured shopper preferences and collected data. Luxury brands saw omnichannel payments as key, with over a third using this strategy to capture data and improve customer experience. And while mid-market watch and jewellery retailers agreed on the importance of omnichannel payments, they also diversify their methods - citing beacon technology as something they’re employing.

And, counterintuitively, use of loyalty cards as a means of data collection is more prevalent in our luxury retail base, lending credit to the assertion that they’re leading the way in implementing innovative ways of selling.

So what do these trends mean for retail in the future?

There’s an integral shift toward demand for personalisation and improved shopper experience. Brands are encouraging shoppers to engage in an experience and to forget they’re undertaking a transaction.

Innovation and technology will play a key role. The thread enabling these advancements to be used practically is a sound payment operation – one that not only facilitates the changes seen in the industry, but also leads the way in developing the innovative concepts themselves.

70% of luxury brands said payments were top priority to user experience, tech innovation and brand perception. This is something their fast fashion counterparts should heed if they want to deliver in the new world of retail. Payments play a key role in a merchant’s success. And while every retailer would prefer to reduce the friction of taking a payment by making them invisible, there is a balance between invisible payments and shopper knowing what they are paying for in a secure way.

Despite the desire for experiential purchasing and the benefits of adding personal flair, security remains one of a buyer’s top priorities – particularly as advancements in technology often exceeds consumer understanding of how it all works.

To balance these expectations, we’re now talking about “translucent payments”, the next generation of invisible payments, wherein we have enough information about the shopper to reduce the friction while ensuring shoppers have full control over what they buy.

This concept can apply to any retail innovation. The digitisation of retail will mean a seamless experience from any device to the store. And experiential technology will integrate with the real world, as it’s already started to do with things like push notifications, GEO tagging, magic mirrors, connected stock and more.

And where VR comes into play, innovative payment technology will allow for a shopper’s card on file to take contactless payments by using a random display of numbers to generate the card’s PIN – all in a digital environment.

Personalisation is where this brave new world of retail can really shine. If customers are known no matter how they choose to browse or buy, the methods already in place in both the luxury world and fast fashion will become more effective.

By improving identification when a customer enters a store, their entire buying history can be made available, helping real life staff make better suggestions. Or, in the case of fast fashion, suggestions based on tagging may be sent to their mobiles, providing shoppers with personal offers as they near the store or departments of it.

The future is bright for retail – with the pioneering innovation of luxury retailers paving the way for the more mass commerce minded fast fashion merchants, shoppers will become better connected to the brands they love.

The Future: Luxury

Luxury has built on the idea of exclusivity. In the past, the shopper was happy to wait for an exclusive product. However, two things are changing the game:

The millennial mentality pervasive throughout all consumer industries: I want it now. I want it right. I want to show the world what I’ve got.

Mid-market companies are looking closely at what they do to “copy” luxury items, concepts and strategies to create a cheaper version that will be available faster to the consumer to meet the millennial expectation.

These disruptive trends have forced the traditional luxury brand industry into taking their creativity outside the fashion line and into marketing and brand repositioning.

To meet these new expectations, brands like Burberry understand the digital and in-person are not two separate concepts – the online world is reality now, and it’s everywhere and everything.

They’re allowing brand loyalists to buy from the catwalk, before other shoppers gets a chance to find something similar somewhere else. In doing this, they’re further developing the exclusivity factor by appearing innovative and securing their place as “must have”.

What do retailers need to keep in mind as they push forward into the high tech world of the future?

The Future: Fast Fashion

When it comes to mid-market or fast fashion retailers, the competition is fierce and companies need to invest to differentiate.

There are a few ways to achieve this, but innovation is a key one that resonates with new generations and will be integral to survival.

The largest benefit in the future will come from an omnichannel approach to the shopping process. With innumerable benefits from both online and offline operations, the mid-market must prioritise innovation in the digital arena.

Taking a page from the luxury handbook, using creativity will be a large part of a merchant’s success as they elbow through the waves of competitive merchants. In this space, innovation reduces barriers to entry.

The concept of creating an offline experience using virtual reality will prove not only forwardthinking, but will also tackle many of the problems retailers in this space face: merchants can remove payment liability and fraud through EMV, define a sales person’s approach to increase attachments in a digital environment and reduce returns by having more interaction with the product they are buying – all without having to invest in a store.

How can we help?

No matter the retail industry or business type a merchant falls under, the rapid shift from in-store to online and from online to virtual offers unique and frustrating challenges.

The best way to move forward is to develop an ecosystem to support a more creative and agile way to serve these changing customer expectations.

Worldpay are uniquely placed to assist brands through our pervasive understanding of the industry and best practices for optimisation, security and user experience. We’ve also got a finger on the pulse when it comes to payment regulations in Europe and beyond.

We’re at the centre of the wider omnichannel retail ecosystem, partnering with platform providers, becoming the preferred payment operator for system integrators and fostering mutual programs with solutions within eCommerce, from translations companies to fulfilment organisations.

We’re also intensely focused on technology ourselves. With a full in-house innovation team that is prototyping how payments should be taken in all the new digital environments in a secure way. We’re pioneering solutions to keep our merchants ahead of the competition, with extensive work around Internet of Things and how we can process payments just by getting an “item” to ask for it, VR, voice recognition, digital ID and more.

If you’d like information on any of these topics, or if you’d like to speak to one of our eCommerce consultants, please get in touch.