Internationalizing Your Brand

How Top US Brands Are Planning to Grow Their European Business

Methodology

In Q2 of 2017 WBR Insights surveyed 200 senior decision makers at major e-commerce retailers in the USA. Participants of the research included: Heads of Retail, Heads of E-Commerce, Heads of Digital, as well as CIOs, CXOs, CMOs, and CEOs, all with responsibility for European retail. All interviews were conducted by appointment over the telephone. The results were compiled and anonymized by WBR Insights and are presented here with analysis and commentary by Arvato.

Foreword:

Thinking globally, acting locally.

Europe has some of the largest and most dynamic e-commerce markets in the world – consumers in Europe shop online more than ever before, and their habits have changed in tandem with the rapid development of technology.

Shoppers in Europe are more comfortable shopping online now than ever before, even for luxury and other high-value items. As a result, improving both their reputation and their reach in Europe should be a ‘no-brainer’ for US brands.

This is a particular advantage for those retailers who have embraced an omnichannel strategy which prioritizes convenience, trust and flexibility for their customers.

Selling effectively into the European market, however, has certain peculiarities which require US brands to take a different approach to market than they may be used to at home.

The first and most obvious difference is in the abundance of local languages, but that is far from all. Different countries have their own shopping habits, preferred payment methods, and logistical challenges to name only a few.

Brands must also decide on the most effective route to market for them in Europe. Do they wish to sell exclusively via local marketplaces? Do they wish to run a localized version of their own online store? Or, do they wish to enhance their local sales, and their brand image by means of a physical store?

Maximizing your brand’s sales in each region requires that you localize your global operation to meet these local challenges. Getting your local strategy right will define your success, or your struggles, in the region.

This report is designed to assess the challenges and the opportunities of US brands which actively seek to expand their footprint in Europe, and what they need to do to succeed.

Part 1

-

Retailing in Europe

Respondents:

Online presence and

physical stores in Europe

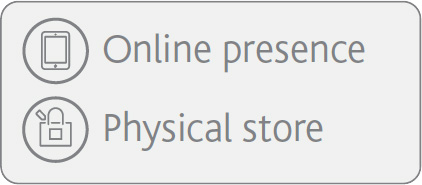

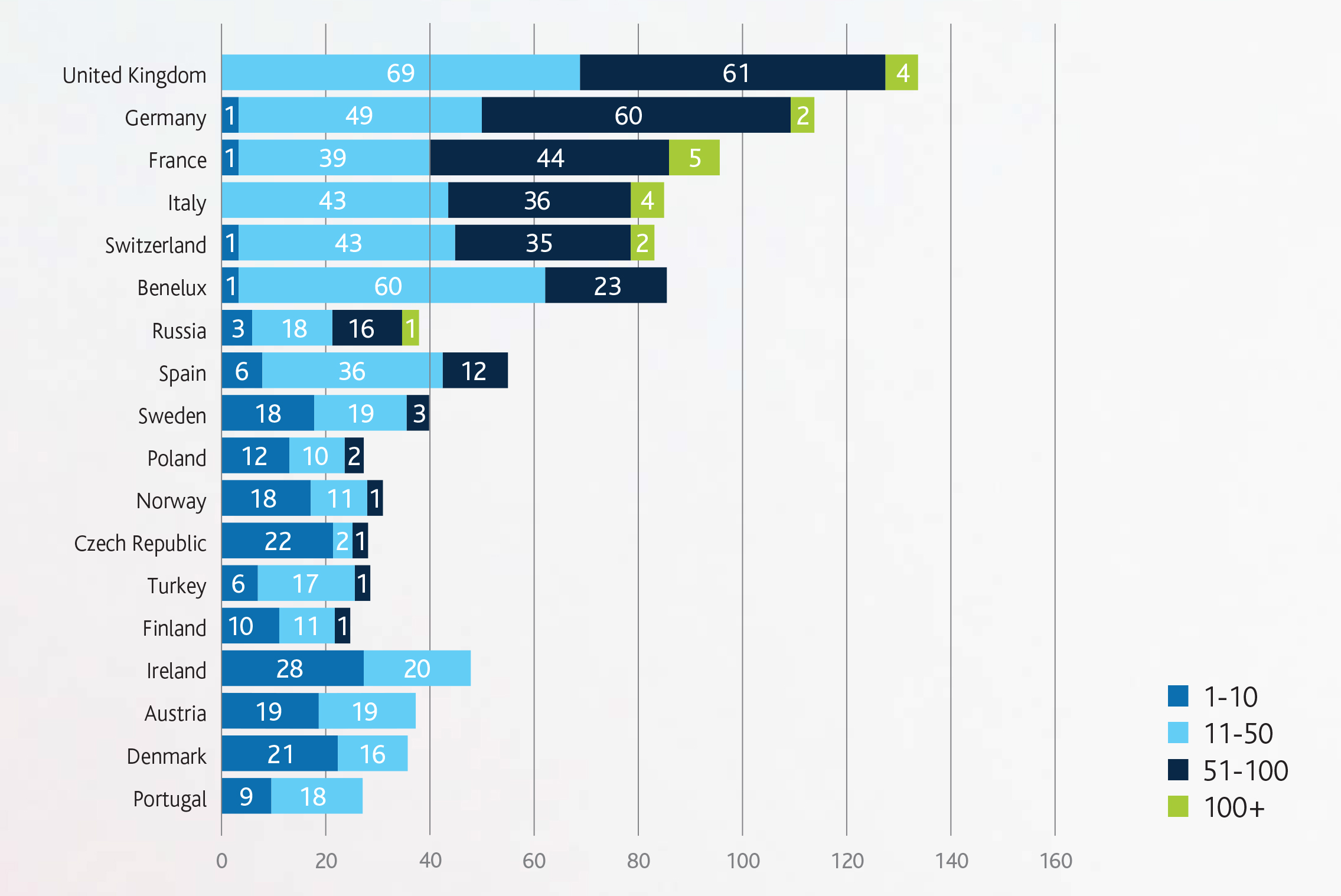

The focus both for physical and online stores is, perhaps unsurprisingly, on the largest economies in Europe. Online, the UK, Germany, and France all have more than 80% penetration by the US brands we surveyed. In terms of physical stores in the region US brands had a similar focus, although the overall penetration is far less. The stand-out figure here is the 85% of US brands which have a bricks and mortar store in the UK. This is due to the fact that the UK has a lower barrier to entry than mainland Europe, as their content does not require translation, and the service offering is very similar to that in the US market.

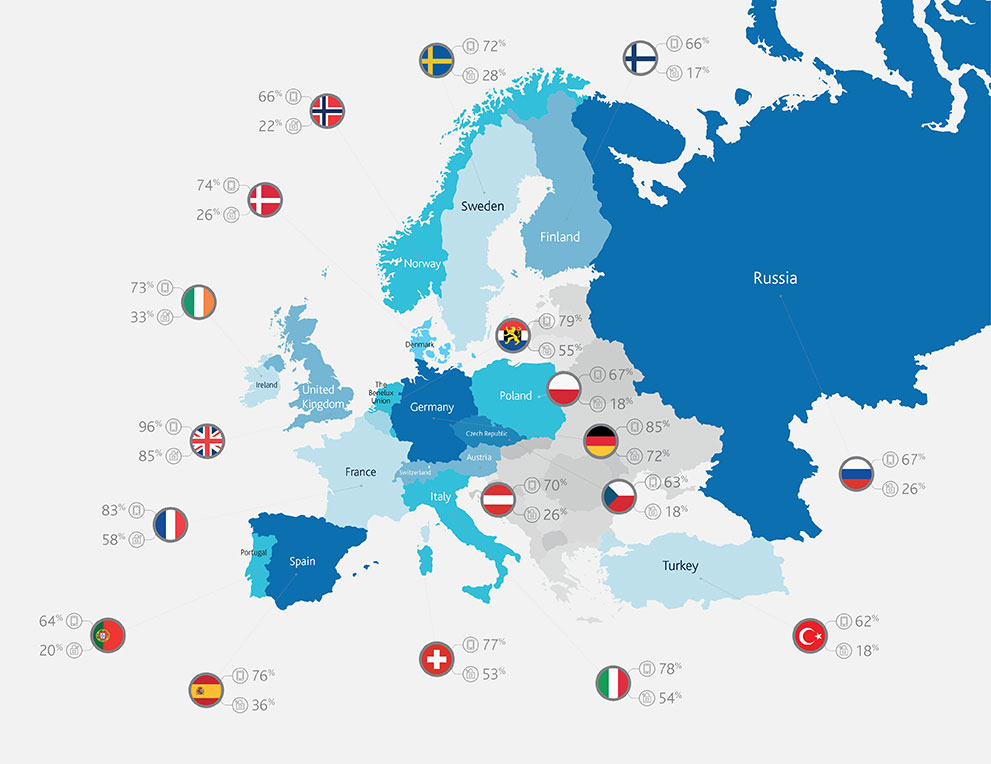

Type of online presence by country:

One thing is very clear from our findings; our retailers are relying on a combination of channels to achieve success in the European market. Of course, different channels present different challenges and opportunities for brands seeking to reach markets in Europe.

Overall, our respondents have focused their online retail presence primarily on the largest economies in Europe: the UK, Germany, and France. More than 80% of respondents in all three markets have diversified their channel approach to include both marketplaces and their own online stores.

A clear trend from the data is that US brands are more likely to be selling their products in unfamiliar European markets via a marketplace then via their own online store.

Operating your own online store gives complete control over your brand, the customer experience, and pricing, and gives you access to far more information in terms of your customer data. Marketplaces on the other hand offer great flexibility and a comparatively cheap and straightforward way to access new and unfamiliar markets. In Germany, marketplaces have become such an important part of the e-commerce landscape that in 2016 they accounted for 50% of all online e-commerce transactions there.

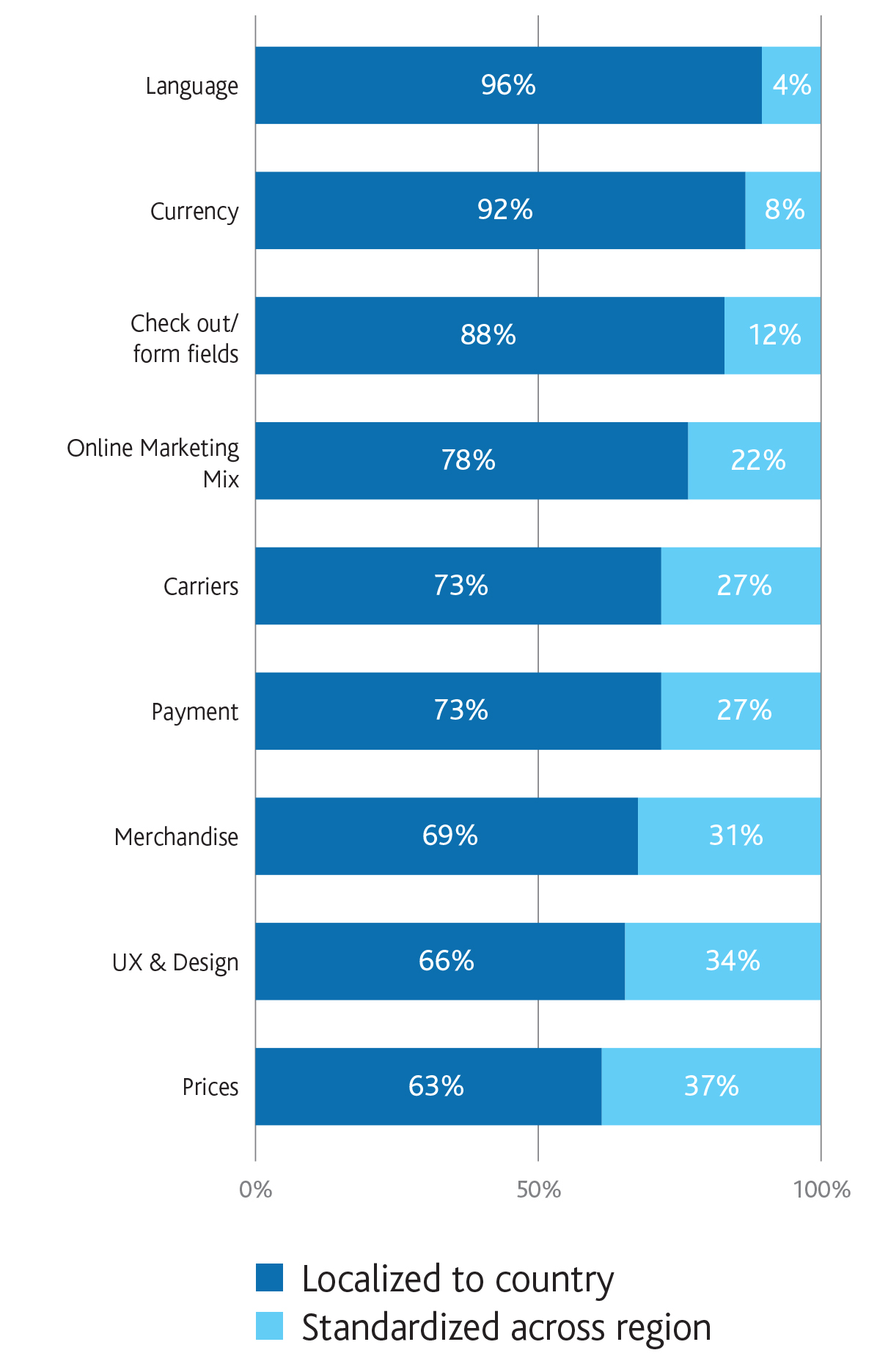

To what extent do you plan to localize your online shops?

Brands take localization seriously, and for good reason. Europe is filled with different languages and cultures, and adapting to this reality is a fundamental requirement for brands that not only want to sell their products in Europe, but also create a positive shopping experience for their customers.

Of all possible localization features, language and currency are the ones brands prioritize first of all – more than 90% of our respondents plan to localize these elements. Localizing the language of your e-commerce website opens the door to the full range of potential customers in that local market, and fosters a sense of trust in the brand, as well as making it easier to use.

The same goes for dynamic detection of the local currency, as well as details relating to payment, and local marketing.

Overall, it is clear that brands understand that the localization of key elements of their site is crucial to their online success. More than 60% of respondents plan to localize all elements mentioned, although elements like merchandise, UX & design, and prices are further down this list of priorities.

Internationalization and the Future of E-Commerce

Frank Kebsch

CEO, Arvato Financial Solutions

What role does internationalization play in your e-commerce business?

The plus of shopping online is that customers can buy whatever they want, whenever they want, from wherever they want. When you sell online, you have the opportunity to reach customers far beyond the confines of your hometown or national borders. But how do you know what they are looking for? How fast do they expect you to deliver? How do they want to pay? Are they even prepared to buy from an international merchant? This is where we help our clients by providing risk solutions, fraud prevention, payment options and customer-friendly collection processes to enhance competitiveness internationally and to enable a convenient customer shopping experience, for industry leaders, through local heroes down to niche players.

Which challenges do you face in such an international environment?

There are currently a lot of changes taking place in the payment market with a lot of talk about Apple Pay and Samsung Pay sewing up the market for mobile wallets. We even have AliPay, the mobile payment heavyweight run by Chinese e-commerce giant Alibaba, moving into Europe and the US to corner the market for Chinese tourists (and possibly the rest of us). Across the board we have found that in payments, as in retail, one size doesn’t fit all. Card is king in many European countries, but you still can’t afford to ignore local payment heroes, such as payafter- delivery in Germany or direct debit in Finland.

The markets are different – on the one hand because of customer needs such as payment preferences, delivery expectations and the regional degree of digitalization, and on the other hand differences determined by legal conditions and data sources. To fulfill local requirements and offer really international solutions, we think globally, but are also present in 20 countries all over the world. We strive to enable our clients to achieve maximum conversion rates to facilitate them to grow internationally.

How do you see the future of retail?

Consumers expect a 360° brand experience. Therefore, brands have to combine retail and e-commerce features: the same offer, the same pricing and the same payment options. Although price might be the first variable they use to determine who or what they are interested in, an increasing number of additional parameters are influencing purchasing decisions. In Germany, 30% to 40% of e-commerce payments are made through PayPal, whereas only 5% to 10% of e-commerce payments are made using e-wallets in Sweden.

We can see this from aggregators and comparison engines, where variables such as availability, delivery times, shipping options and even payment methods are coming into play. Even if you don’t win on every aspect, you still need to tick as many of the boxes as possible. To enable you to do this, you need to know what’s happening in your industry, in your market and in your demographics.

Consumer expectations vary considerably for both physical goods and digital services. You need to consider local legacies – how each market has evolved over time – and for that, you go back to ‘before digitalization’.

How do you prepare for this future of commerce?

Comparison is at the heart of cross-border e-commerce. The research in our Arvato Payments Review* confirms our observation that some markets are more open to shopping across national borders, while others are more comfortable with their local retailers. Why some and not others? For some markets, consumers are simply happy with what they can get locally: selection, service and prices match their demands. But there are often other factors at play. Trust is one of the big ones. Consumers who are reluctant to shop internationally are often concerned about how warranties and returns will work if they buy cross-border.

To support convenient shopping we have to enable the offering of the same tools – same payment methods including risk analysis - to retail as currently and in future for e-commerce business. In order to increase trust and minimize the media gap between e-commerce and retail, the link between customer loyalty and payments will be a focus issue in the future.

*Source: http://payments-review.arvato.com/

Frank Schirrmeister

CEO, Arvato SCM Solutions

What role does internationalization play in your e-commerce business?

The business is changing constantly and the market is very dynamic. So, growing our service offering as well as our international footprint is key to our clients. As partner with more than 15 years’ experience in the e-commerce business, we create tailor-made and innovative solutions to enable our clients’ growth. Especially in the past years, our clients grew fast in different international markets with localized services for their customers. Therefore, the expansion of our international infrastructure and the setup of distribution centers in strategic relevant markets, such as the US, Netherlands, France and Poland, besides Germany, are our main investment into the future. Since the beginning of 2016, we have extended our total global warehouse capacity by 25% to more than 1.5 million m² today.

Which challenges do you face in such an international environment?

Speed of delivery, connected customer experience across channels and countries, and seamless processes across all IT-systems are only a few challenges our clients face. The right setup of infrastructure and data to create the perfect shopping experience for the end-consumers are important. Thus, we offer fast and flexible state-of-the-art solutions for full-service e-commerce, digital commerce, omnichannel and loyalty programs – speed and customization to brands’ unique DNA are crucial. This is reflected in several awards our clients have won. For example in the last two years, the winners of the “Fast Track Pacesetter Award” of Salesforce’s Commerce Cloud have been Arvato clients.

Talking about omnichannel: Do you think that US brands are more experienced in this field?

As you see in this report, US and European brands face the same challenges with regard to the identification of their customers across channels. Having a consistent view of the consumers is only one part of omnichannel. We have done numerous omnichannel consulting and integration projects, for example the cross-channel loyalty program for the German Fashion brand MARC O’POLO. Based on this experience, our digital commerce consulting team has developed a free online quick check with the 39 most important questions that allow companies to identify their readiness to offer omnichannel services easily.

How do you see the future of retail?

In the future we will see more smart technology substituting manual processes. Already today, process innovations such as smart glasses and robotic picking in the picking process, as well as chat bots in customer service, have increased efficiency. New shopping concepts will evolve by using even more technology-based automation and data-driven artificial intelligence. However, despite all technology, customer centricity is key. Very personalized customer communication and intuitive shopping solutions across channels will create a more comfortable omnichannel shopping experience.

How do you prepare for this future of commerce?

We invest in new technologies: our clients already benefit from our globally integrated IT systems and 63 warehouse locations in 20 countries. As market requirements are rapidly changing, we continue to invest massively in this global infrastructure and IT systems. To maintain our leading position in fulfilment we invest into omnichannel warehouse automation, technologies such as pick-byrobots and order management systems. At the same time, we invest heavily into our Digital Commerce Strategy & Development unit, and integrate and operate online store platforms like Salesforce Commerce Cloud and mobile solutions. The combination of global fulfilment, frontend development and UX oriented strategy consulting makes Arvato a unique player in the global full-service market. Our mission statement is to provide high quality, client-focused international supply chain management services – to create tailor-made and innovative solutions which enable our clients’ growth and transformation. In addition, we focus specifically on new solutions and digital value-adds.

Part 2

-

Expansion & Development

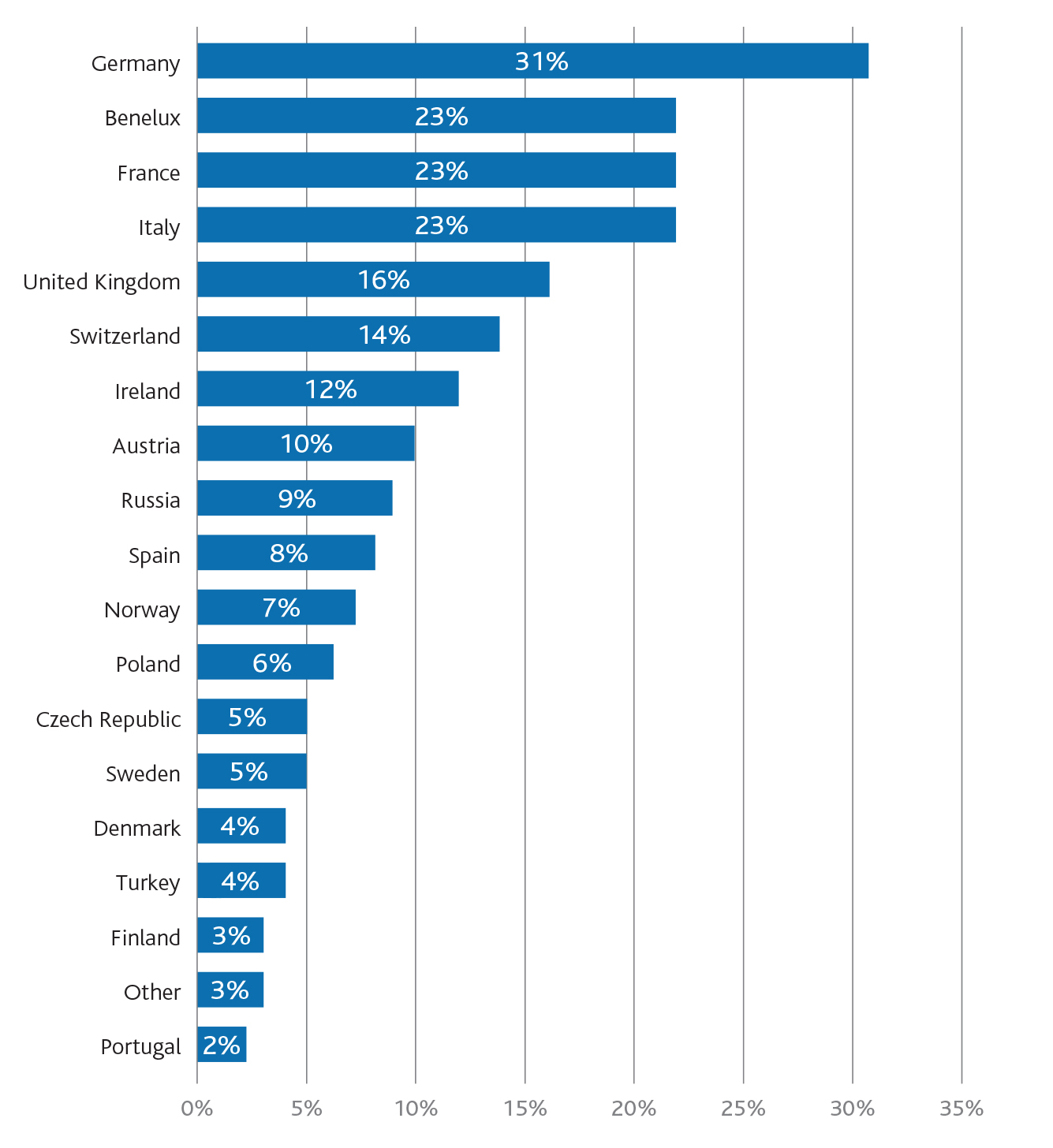

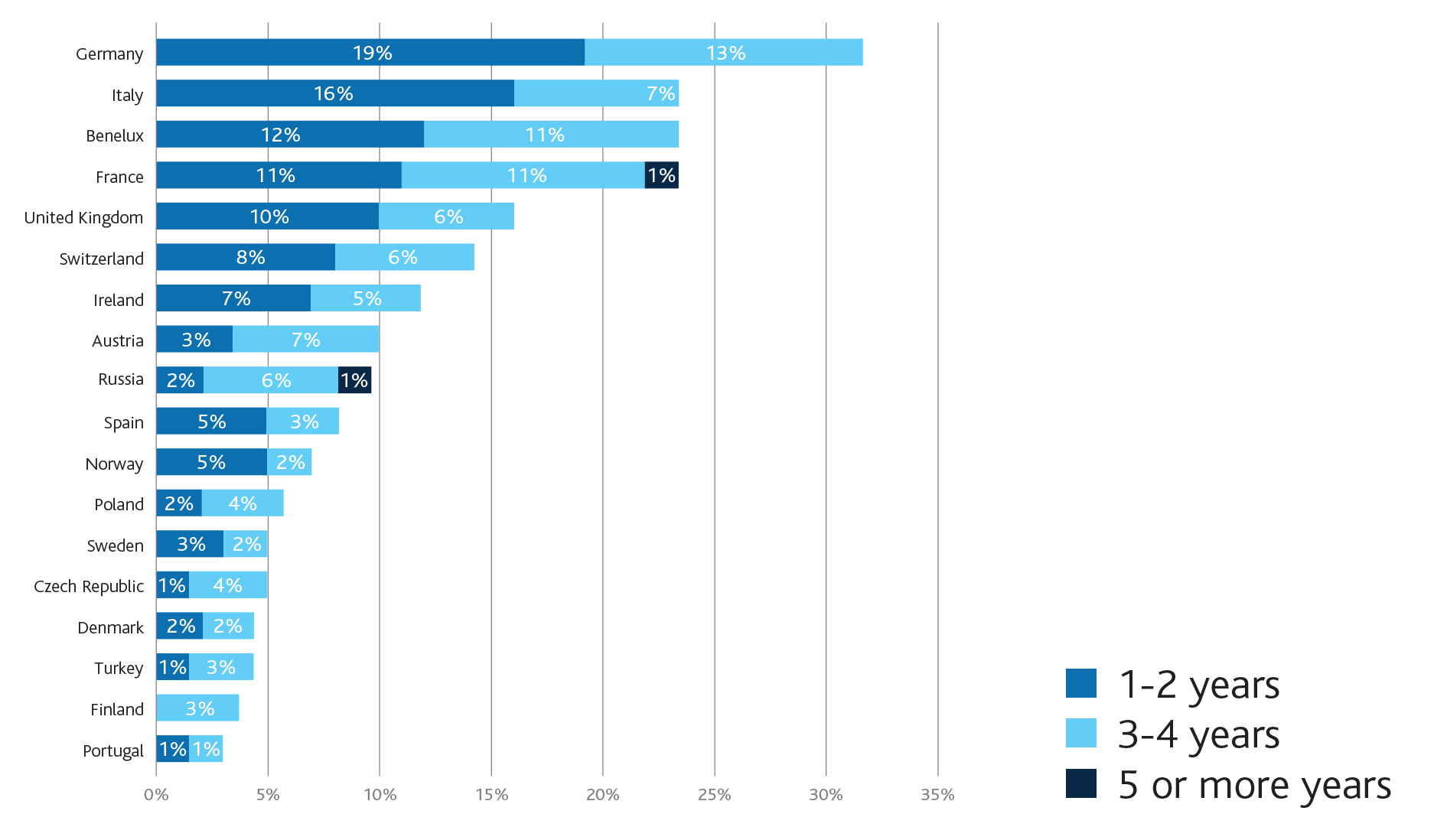

Which countries do you plan to expand into?

What’s your timetable for this expansion?

52% of responding brands currently have plans to expand their business outside of their existing European footprint.

Germany stands head and shoulders above the rest of the European countries for US brands who seek to expand their existing footprint; more than 30% currently have plans to grow their business in this market. Their interest is likely fuelled by a strong local economy, and a well-developed infrastructure to support such expansion. Germany is also the country into which brands want to move into soonest, with two thirds planning to make their move within the next two years.

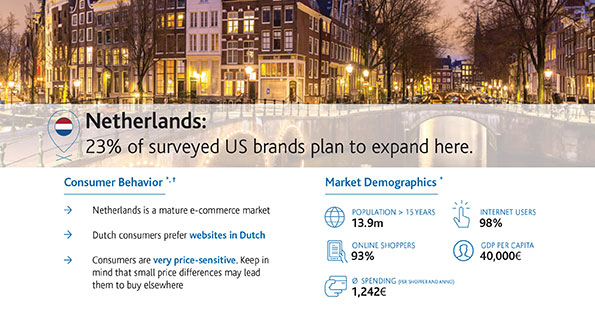

Following Germany; Benelux, France and Italy all appear high on the list of expansion priorities. All are either welldeveloped e-commerce markets, or are about to become so. However, shoppers in these regions are very sensitive to price differences, and also prefer their websites to appear in their local language. It will be important for brands to get their localization strategy right when expanding in these regions.

What is also interesting about these findings is how low the UK appears on the list. This may be in part because, as we saw earlier, that many brands already have a significant presence in the UK. However, the drop in the value of the pound since June 2016, as well as ongoing uncertainty around the effects of Britain’s departure from the European Union are also contributing factors.

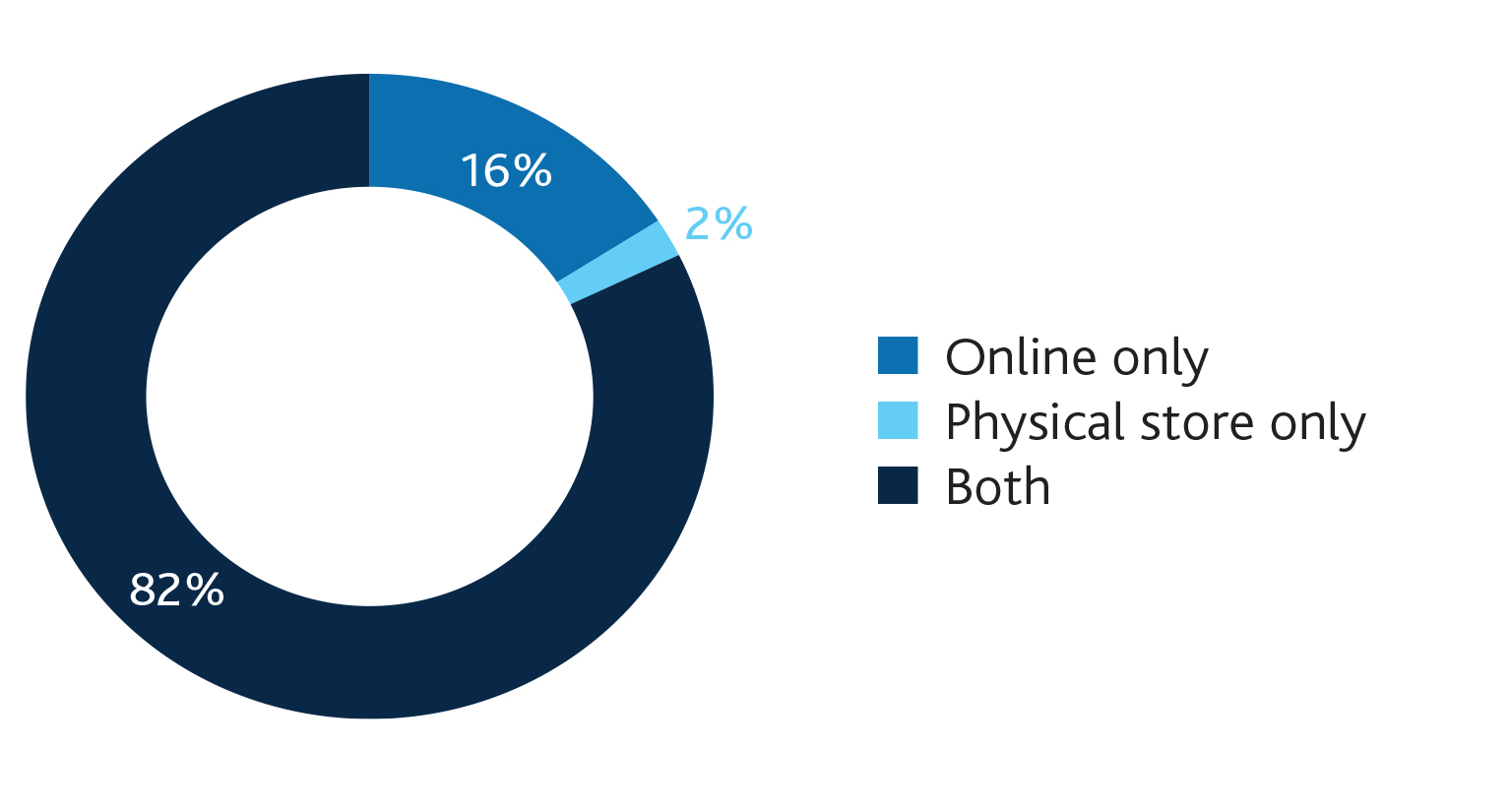

Is your expansion…

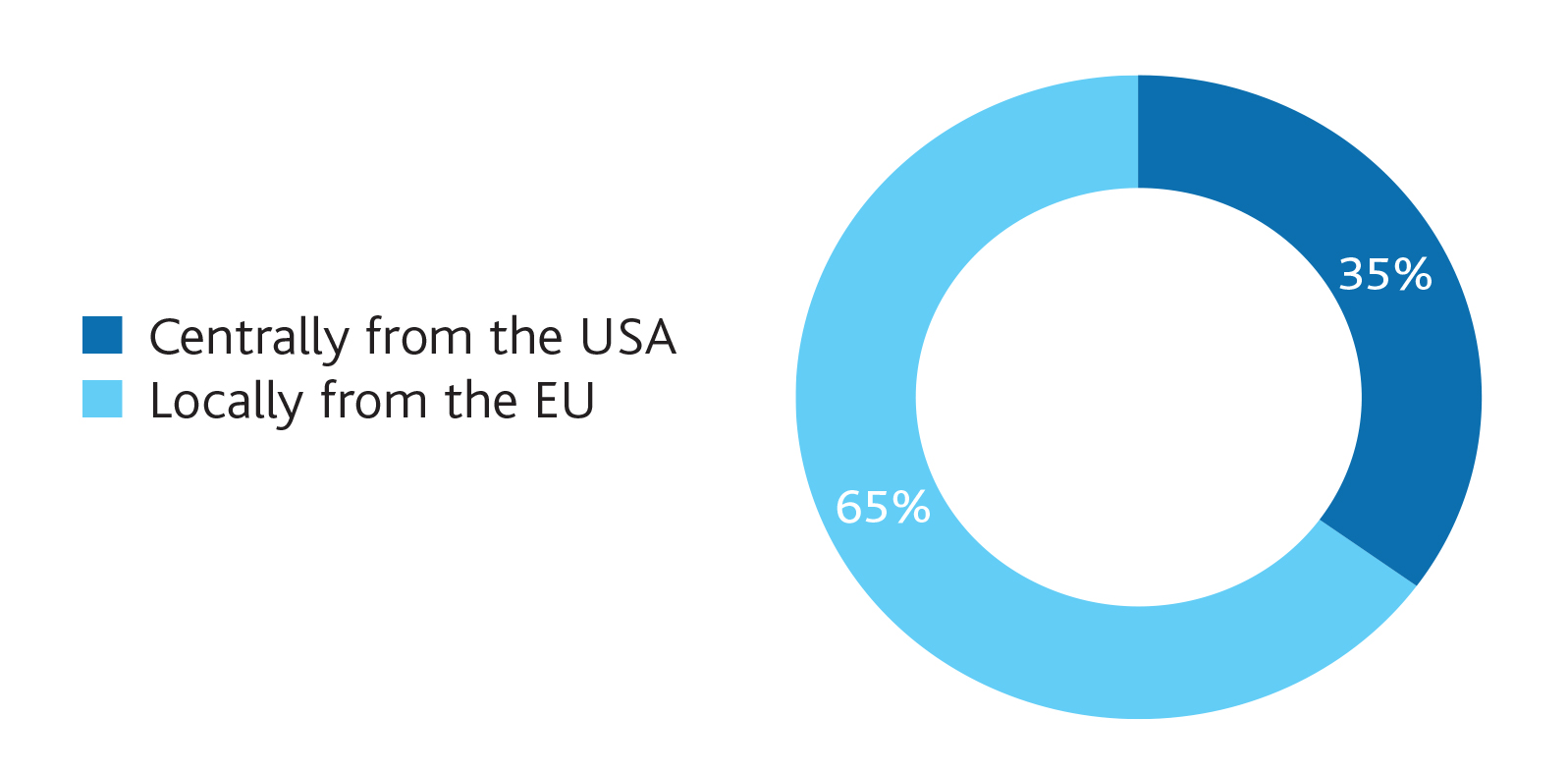

How do you manage your European business?

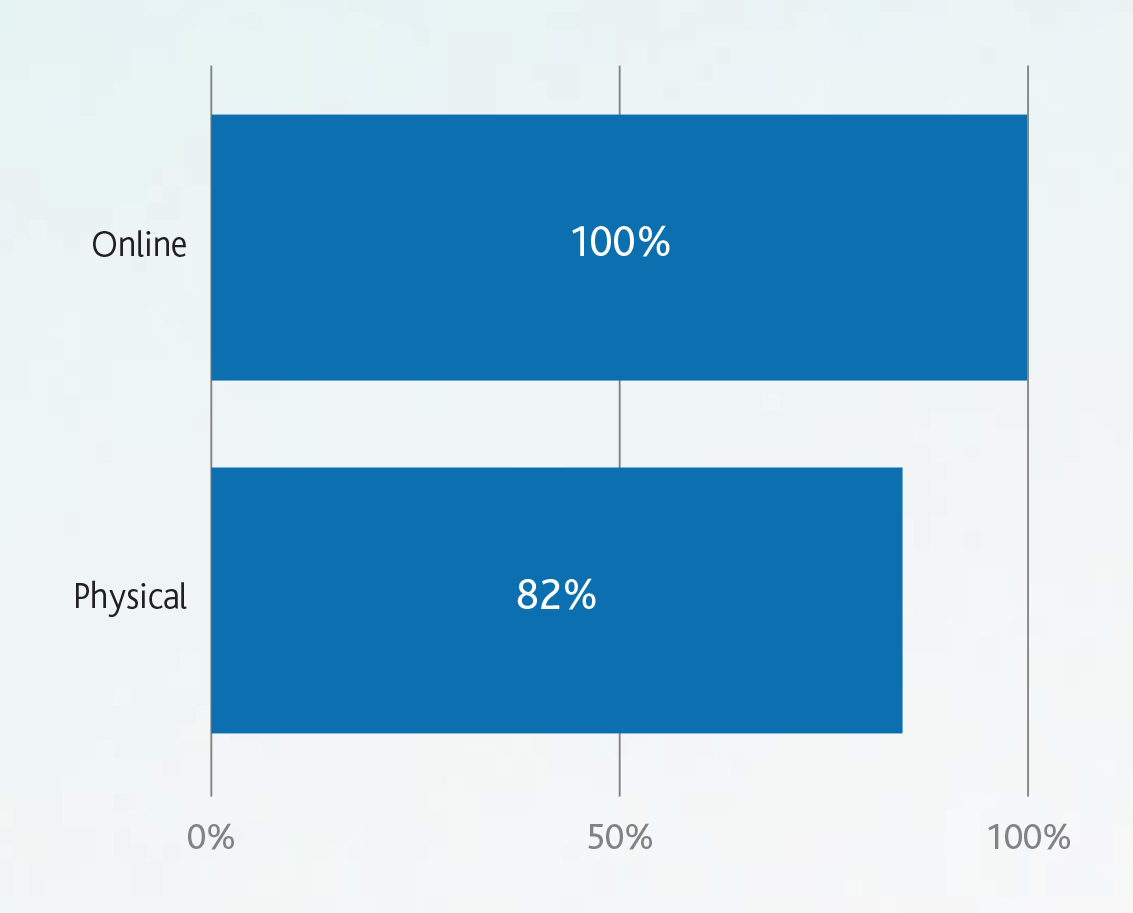

Those who believe that the days of high-street retailing are numbered should pay attention to what brands are saying about their expansion plans in Europe. More than 80% of respondents who have plans to expand their footprint in the region intend to do so with both physical and online channels.

Physical stores are a powerful driver of brand perception, of innovation, and also of sales. For brands seeing themselves as leaders amongst their peers, and especially for luxury brands, there are few better opportunities to influence customer perception than that offered by a physical store.

This is further underlined by the response of the up-and-coming ‘generation z’, who, despite being ‘digital natives’ an IBM study found overwhelmingly prefer to shop in store.* It is also interesting to see that 35% of our respondents currently manage their European business centrally from the USA. Given the importance of getting localization right in Europe, it will be even more important for these brands to tap into the local knowledge of the European market, either from their employees in-country, or by sourcing local knowledge from outside the company.

*Source: https://nrf.com/resources/retail-library/uniquely-gen-z

Top five challenges when expanding in Europe:

Moving your operations into new and unfamiliar territory raises a number of significant challenges. Many of our respondents were concerned about the costs associated with expanding operations in Europe. The specifics of these cost-related concerns ranged quite widely, from paying more rent on new physical retail locations, to setting up new supply chains, and paying the required local taxes.

Competition was also regarded as an important challenge, in developed European markets, brands must be careful that they are not moving into a region which is effectively saturated. In addition to that, brands must consider how to differentiate themselves amongst their competition; are they best equipped to compete on price, on quality, on shopping experience, or something else?

It can be difficult to grasp the relevant rules and regulations in Europe, and for US brands this was a considerable stumbling block. From regulations which restrict the ability of a brand to set up a physical store, to region-wide employment and environmental regulations, there is a lot of information required to understand this complicated facet of international expansion.

Market volatility is also a major challenge for companies planning to expand in Europe. This goes hand in hand, of course, with any potential political turbulence. From the reality of Brexit, to the potential for Grexit, Frexit, or even Ita-leave, there are plenty of regional political situations which could yet upset regional market stability.

Finally, respondents named a lack of local data and information as a problem. Information and data should provide the cornerstone of an expansion strategy, and gathering such information is a prerequisite to success in the region.

What is the biggest challenge facing the expansion of your brand in Europe?

"Hackers and cyber criminals are a major problem and hurdle to growth in the company and affect our company and our expansion in Europe. Keeping our information secure has become very important."

Survey respondent

"Lack of understanding of consumer tastes and preferences is a major problem, getting this information has been quite difficult. When expanding in to new markets we had to change our pricing strategies but did not do this well leading to losses and problems."

Survey respondent

"The Brexit vote has brought about a lot of uncertainty, and the devaluation of the pound has affected our returns. The market is shrinking and uncertain regulations also pose a major problem for the company."

Survey respondent

"Regulatory issues – we are trying to develop and expand in the European market but because of [issues with regulations] we have had to put a few of our growth strategies on hold. Finances have also been difficult to manage because of these costs and regulations."

Survey respondent

"Expanding in the European market is not very easy, as there are many hidden risks and regulatory issues that will interfere with our expansion in to the market. Developing our products to suit the market is important and we need to conceptualize our strategies to manage this."

Survey respondent

"Anticompetitive laws - it is not easy trying to expand into new markets, from market problems to problems managing employees. It is complicated growing and expanding in the market and it affects our strategic approach."

Survey respondent

How do you manage your European business?

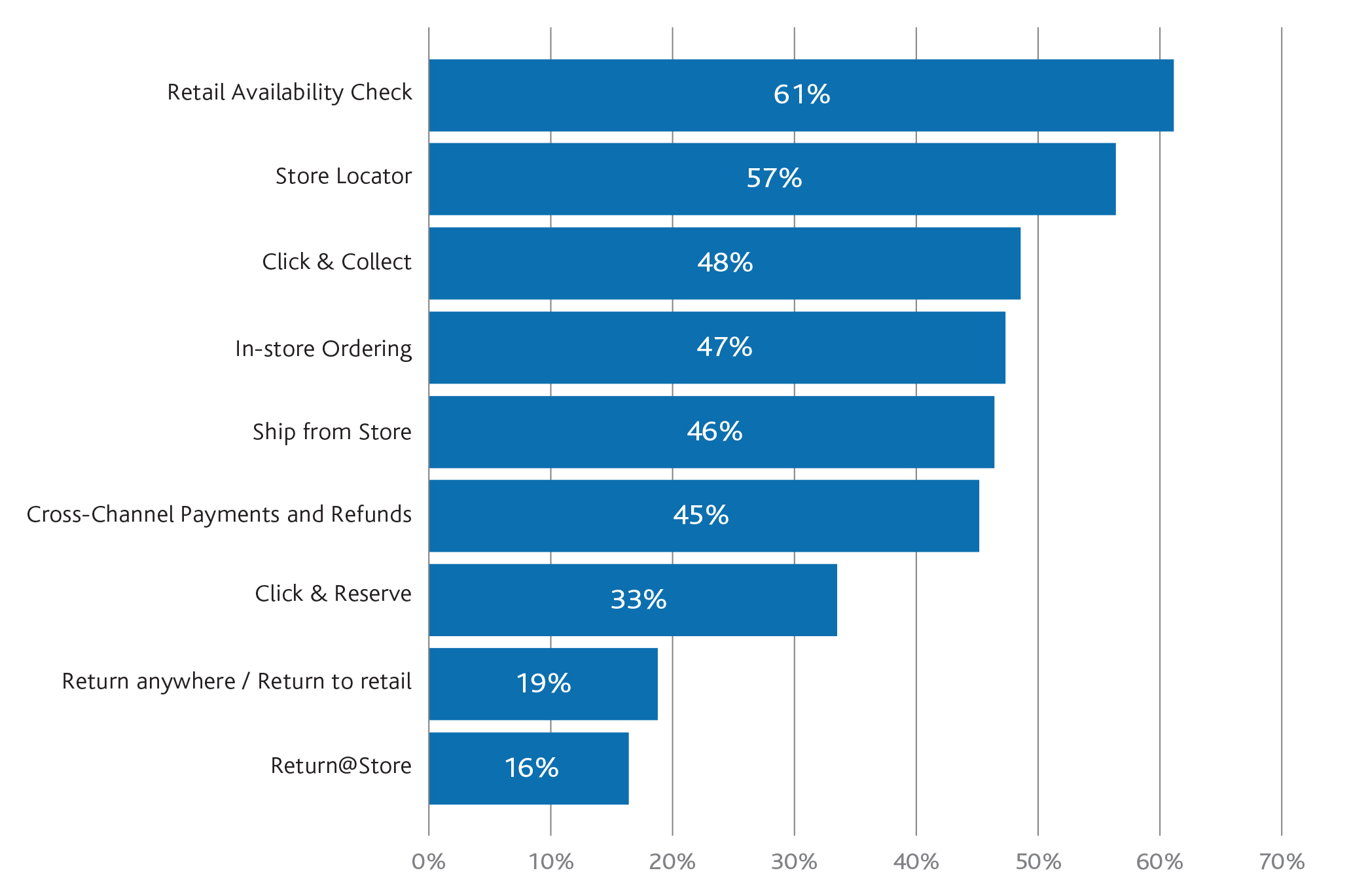

Definitions for the above services can be found in the Glossary on page 28.

Omnichannel has been a major topic of conversation in retail circles for some years now, however, in that time it has become a necessary part of the strategy for any leading brand. Omnichannel is what breathes life into your brick-and-mortar store, and adds the personal touch to your e-commerce operations.

US brands are focused first of all on practical, pre-sale omnichannel functions for their expansion in Europe. More than 60% of respondents plan to implement an online stock-checker and just a few percentage points fewer will add a store locator too. One of the most well received features for customers in this omnichannel revolution in the click and collect functionality, due to be prioritized here by almost half of respondents. Click and collect has been somewhat of a revelation for those who were looking for a new direction for their physical stores. Previous research commissioned by Arvato found that 47% of customers prefer the store as a collection point for orders that they made online.*

Developing an omnichannel strategy in a new region should be carefully planned and executed, especially in regard to payments and refunds. It is imperative that retailers properly connect both online and offline channels in order to properly administer this functionality, as it is so important for customers that this process works seamlessly.

*Source: https://scm.arvato.com/en/cases/scm-cp-omnichannel-survey-registration.html

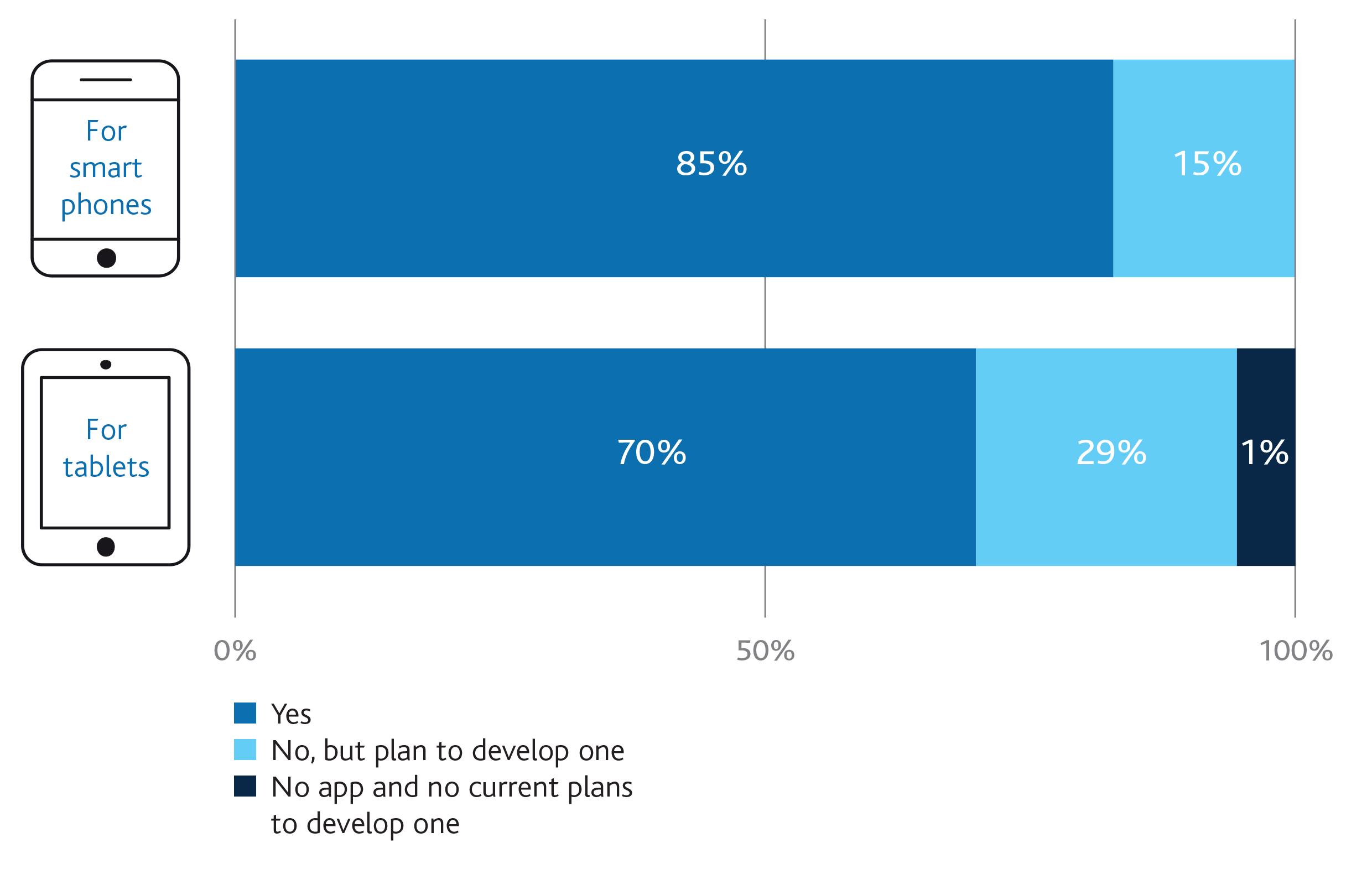

Do you have a shopping app, or do you plan to develop one?

Sales on mobile devices have seen rapid growth in the last five years, exceeding predictions by some order of magnitude. This can be attributed to a seismic shift in consumer buying behavior, and an expansion of trust in the platform by consumers – even for big ticket items. As such it is perhaps not a surprise to see that more than 80% of respondents already have an e-commerce enabled app for smartphones and the rest have plans to develop one. Shopping apps designed specifically for tablets are slightly less common, at around 70%, but still popular with nearly a third of respondents who plan to develop one soon.

The importance of being mobile-ready in terms of your e-commerce operations is not lost on retailers, the data gathered on customer shopping habits over the last few years are conclusive. Research carried out by Criteo found that apps convert on average three times more product viewers than a mobile web shop.*

In addition to this, apps can also be integrated into the in-store shopping experience, like using beacons to send proximity-based notifications to customers to help drive footfall in-store.

*Source: http://www.criteo.com/media/5333/criteo-mobile-commerce report-h12016-us.pdf

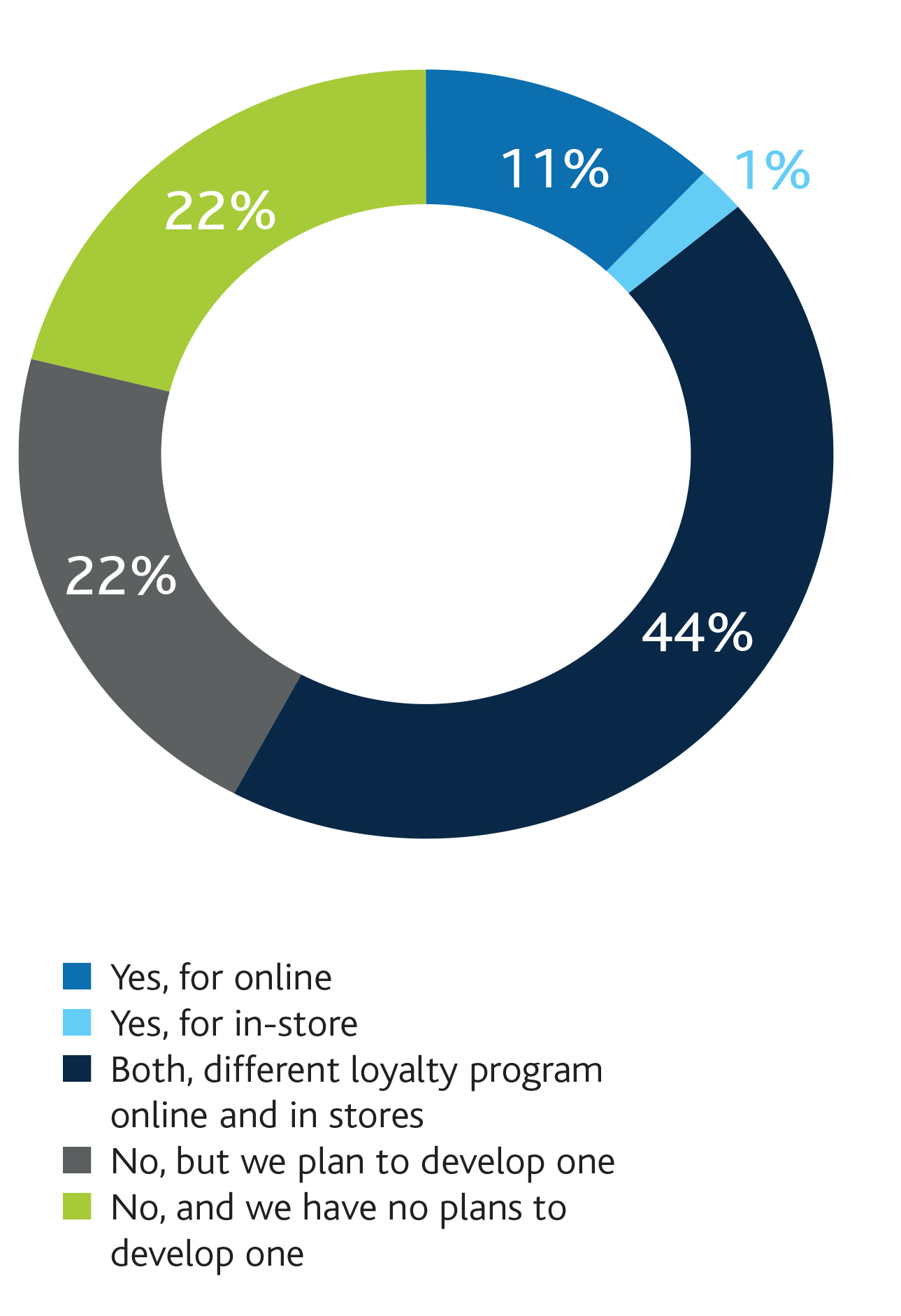

Do you have a loyalty program for your EU operation?

Loyalty programs are increasingly used as a method to drive customer lifetime value, and also as a way to gather data for personalized marketing campaigns. Very interestingly, only 22% of respondents currently have the same loyalty program for both their online and in-store commerce operations.

Since customers expect a seamless experience between the various channels, it is mandatory for retailers to integrate their loyalty programs. As a prerequisite, one needs to consolidate customer data from online and offline interactions in one place. For example, customer data from online purchases and offline purchases can be consolidated in a central omnichannel order management system that receives all orders from online stores and is integrated with POS systems and cash registers. Such a central database, which is automatically created whenever one uses a strong omnichannel order management system, enables loyalty programs that cover both the physical and the digital world. A central database for online and offline customers also enables targeted and personalized marketing campaigns across all channels.

Part 3

-

Payment Trends

In Europe, consumers prefer using a mix of generic and local payment methods.

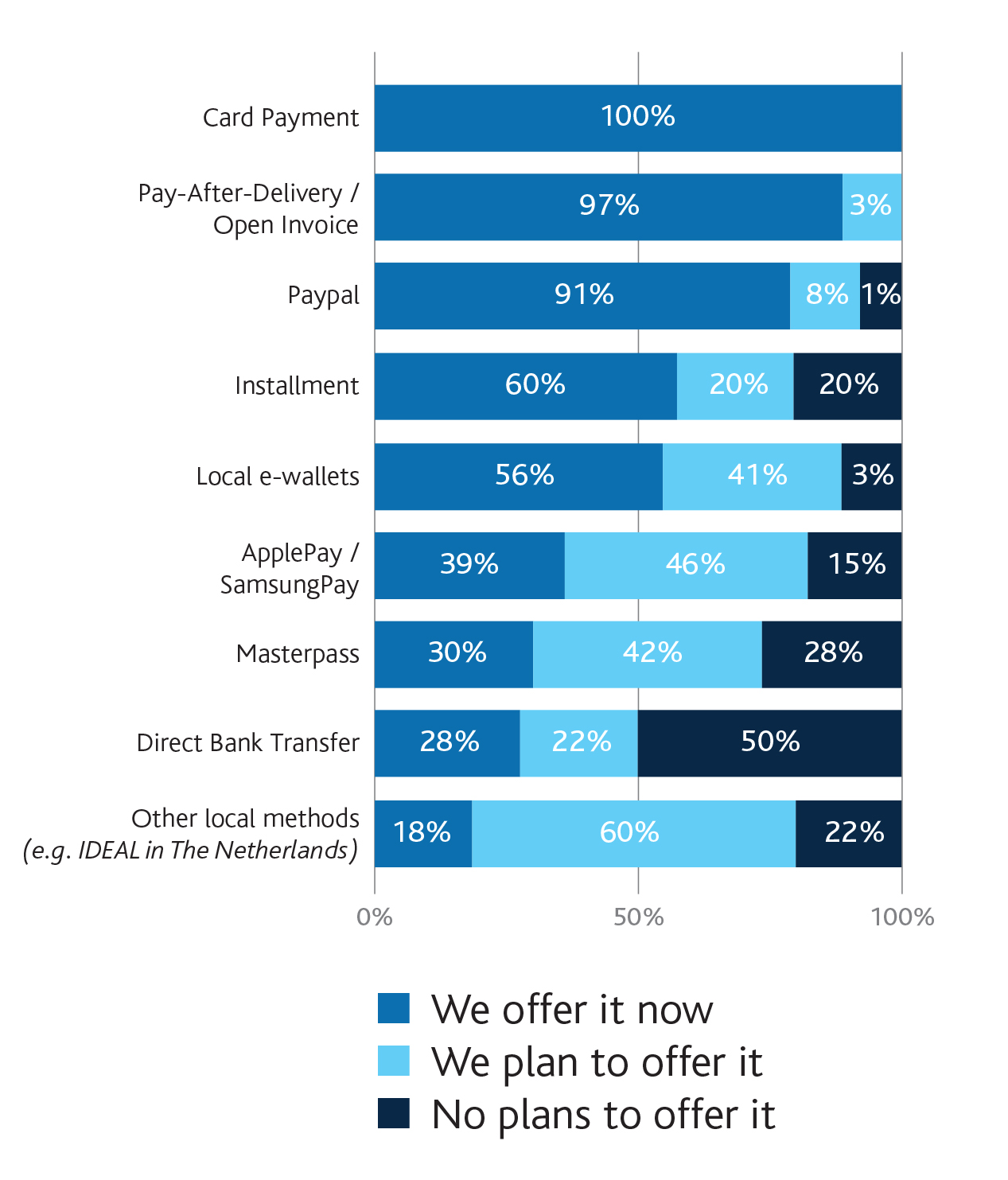

Do you offer or plan to offer these payment methods?

That card payments are ubiquitous across the e-commerce landscape should hardly be a surprise! What is more interesting is that so many offer payafter- delivery or open invoice payments. This suggests a strong understanding of the shopping preferences of European shoppers amongst our responding retailers.

Another interesting finding here is that so many retailers offer, or plan to offer, payments via e-wallet. ApplePay in particular has grown significantly in the markets where it is available; in the UK monthly transactions have grown by 300% since the beginning of 2016.

* However, the ability of the big names like ApplePay and SamsungPay to grow in mainland Europe has been stifled by the limited support of local banks. As a result, retailers may also look at local solutions like MobilePay, Vipps and Swish.

One area that international retailers should consider is offering payment by direct bank transfer. Our research shows that only half of retailers offer it, or plan to offer it. Instant payments are likely to gain significant momentum in Europe in the next few years. Especially with the continued rollout of the Single Euro Payments Area (SEPA) over the next 12 months, this will be an interesting area to watch in future.

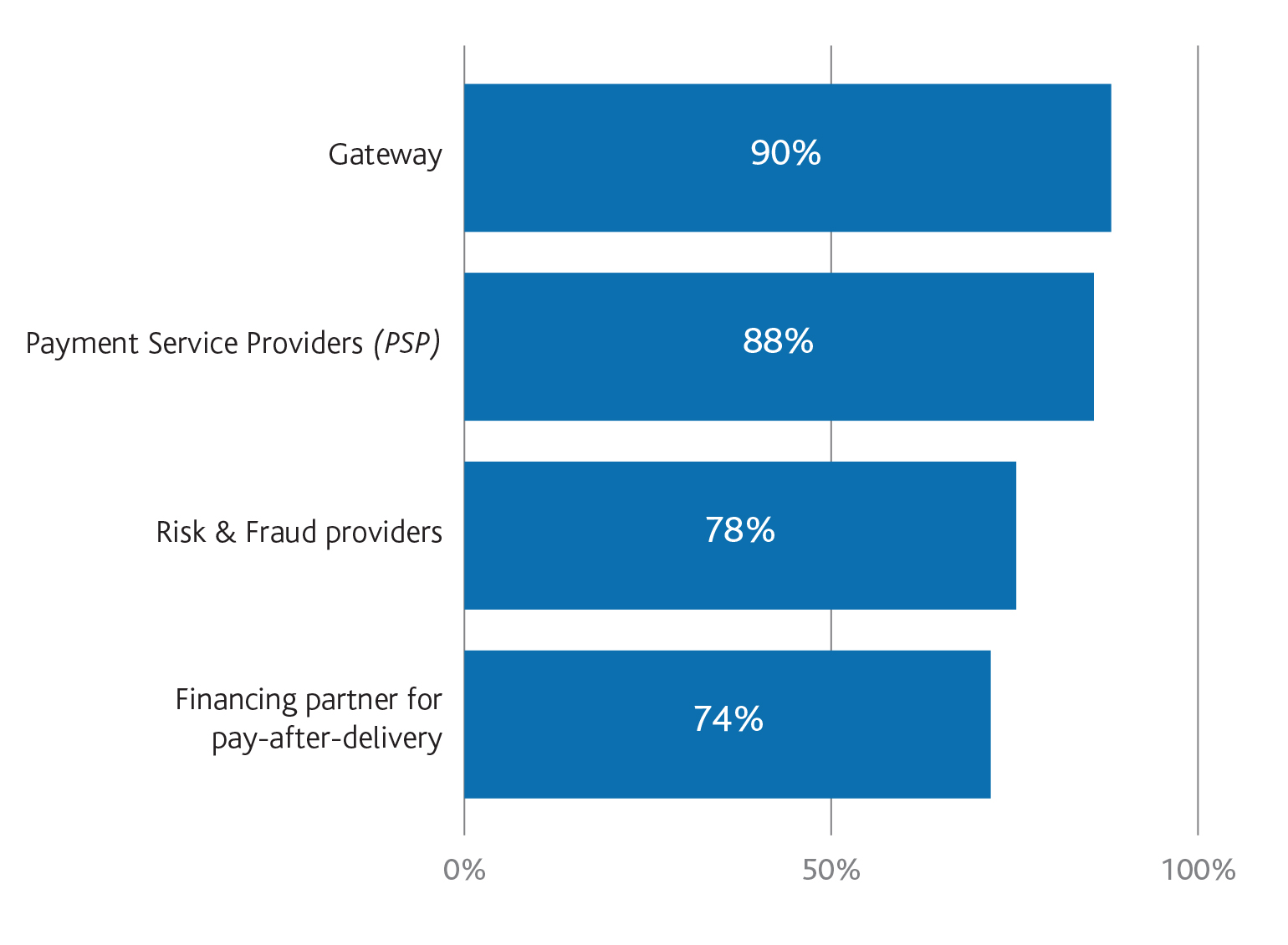

Do you use an outsourcing provider for your payment processing? If yes, which ones:

Established outsourcing providers are a trove of priceless information and skills for international merchants. Nearly 90% of our respondents work with payment service providers and 79% with risk and fraud providers.

It’s also fascinating to see that 74% of respondents are using a financing partner for pay-afterdelivery. Most likely, only the very largest retailers could afford not to do so, especially if they are also offering financing options to customers at the point of sale.

The diverse payment mix requires integrated risk and fraud solutions – What kind of solutions do you plan to have in your payment setup?

"We use multiple technologies in our business, when managing payments and we are very careful to make sure that they are secure and efficient. We also have a well developed IT team to manage any risk that we could face that could affect our brand." Survey respondent

"We have tried to develop our systems to make sure we can control growth and monitor all our transactions, which has helped us develop our overall platform very efficiently and has improved the way we grow." Survey respondent

"We depend on third parties to help us manage risks and fraud and have factored in different risks that we are exposed to and have systematically dealt with different risks to avoid any potential losses or problems." Survey respondent

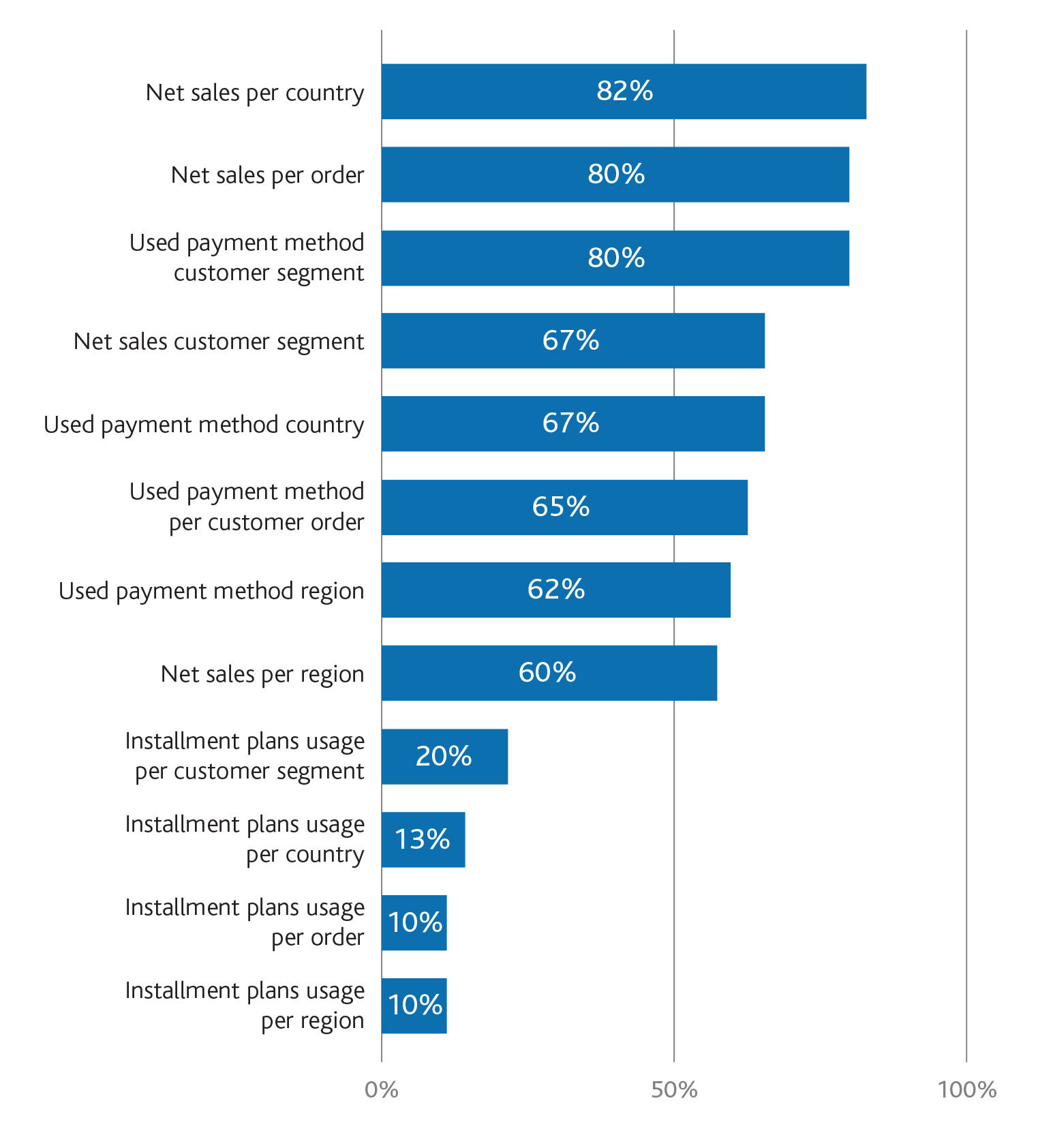

Which of these information details could add benefit to your Google Analytics?

69% of responding brands do not currently take payment process information into account as part of their campaign evaluation in Google Analytics.

Looking at payment process information as part of the customer and campaign evaluation in Google Analytics is an invaluable way to evaluate all kinds of campaign metrics, from national, or regional performance right down to granular insights at the customer level.

Our retailers were most keen to see net sales per country, followed by net sales per order – indicating a focus on top-line performance. However, there was also some interest in uncovering details relating to marketing performance, like net sales by customer segment.

Appendix:

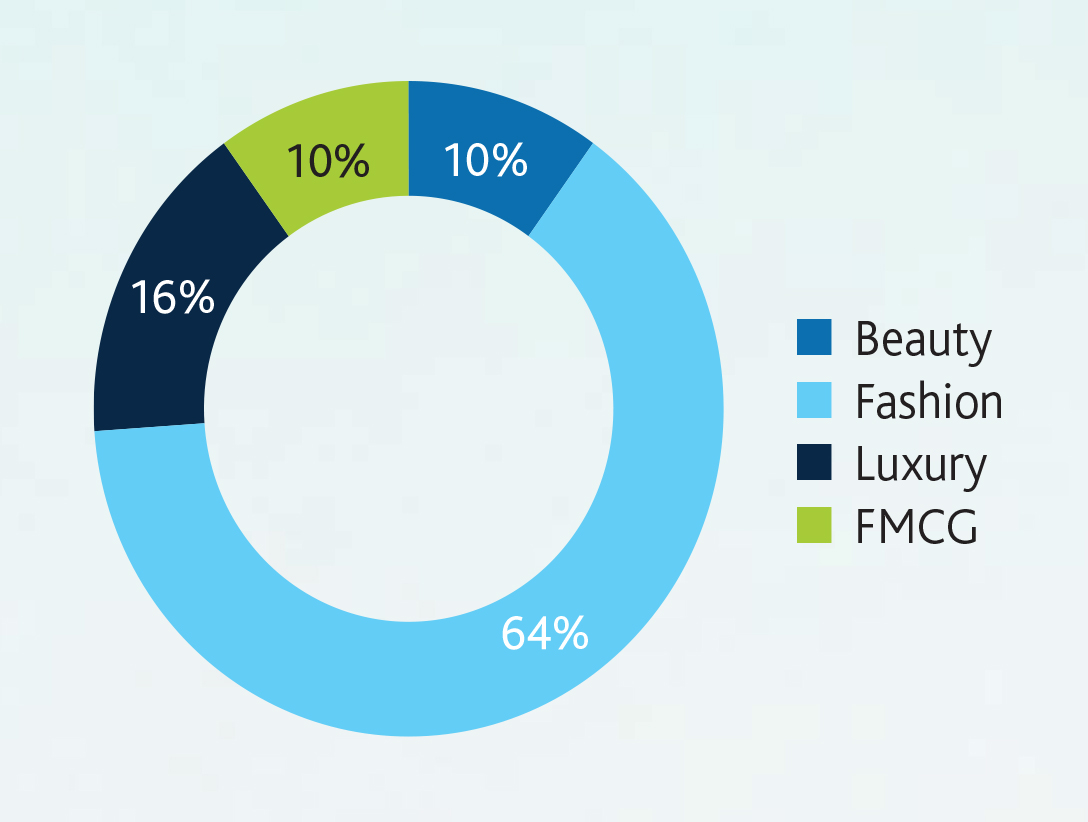

Respondent retailers: Verticals

What kind of European retail presence do you have?

How many stores do you have per country?

Glossary

Omnichannel Feature List

Feature Description

Click & Collect

Order online, pick up in store. Customers can order a product online and pick it up in the retail store. The purchase including the payment transactions happens in the online store

Return@Store

Return an online order in store

Click & Reserve

Customers can look up a product online and reserve it for pick up in the retail store.

Cross-Channel Payments and Refunds

The customer pays for the product at the retail store. Customers may pay for a product that has been ordered online in the retail store and vice versa. Refunds can be paid out in the retail store and by means of online processes.

Return anywhere/Return to retail

Return an online order in a retail store.

Ship from Store

Ship the order from store if available (instead of the warehouse)

Retail Availability Check

Online check of availability in retail store

Instore Ordering

Order online in a retail store (e.g. via tablet) also called “Endless Aisle”

Store Locator

On their website/mobile app

References

E-Commerce Report (2015/2016)

https://www.ecommerce-europe.eu/

E-Commerce News Europe (2016)

https://ecommercenews.eu/ecommerce-per-country/

E-Commerce Worldwide - Germany Passport (2015)

http://www.ecommerceworldwide.com/germany/ecommerce-in-germany

Remarkety (2015)

https://www.remarkety.com/global-e-commerce-sales-trends-and-statistics-2015

National Retail Federation

https://nrf.com/resources/retail-library/uniquely-gen-z

Is Omni Everything?

https://scm.arvato.com/en/cases/scm-cp-omnichannel-survey-registration.html

Criteo, Mobile Commerce Report (2016)

http://www.criteo.com/media/5333/criteo-mobile-commerce report-h12016-us.pdf

Apple Q2 2017 Earnings Call Transcript

http://www.nasdaq.com/aspx/call-transcript.aspx?StoryId=4068153&Title=apple-aapl-q2-2017-resultsearnings-call-transcript

For more information on Payment Methods, Risk and Fraud, and Consumer Behaviour in 14 of the most vibrant e-commerce markets in the world: http://payments-review.arvato.com

The study was commissioned collaboratively by Arvato Financial Solutions and Arvato SCM Solutions

About Arvato

Arvato is an international service provider. About 70,000 employees in more than 40 countries design and implement innovative solutions for clients from all over the world, covering a wide range of business processes. These include CRM, SCM, financial and IT solutions. In short: we manage the flow of information, products and money.

Our clients, leaders in a wide range of industries, rely on Arvato’s portfolio of solutions: from telecommunications providers and utilities companies through banks and insurance companies to e-commerce, IT and internet providers.

Arvato is a Bertelsmann division.

Arvato Financial Solutions - Convenience in Every Transaction

Arvato Financial Solutions is a global financial services provider and part of Bertelsmann as a subsidiary of Arvato.

Arvato Financial Solutions sees itself as a driver for digitization of all financial processes worldwide. Around 10,000 employees in 22 countries offer flexible fullservice solutions for efficient management of customer relationships and cash flows.

With its innovative e-commerce solutions, Arvato Financial Solutions optimizes each and every step of the check-out process of your online shop. From risk & fraud management through the payment process to debt collection, Arvato Financial Solutions helps you to increase your conversion rate and provide your customers with a positive shopping experience.

Arvato SCM Solutions - Engineered to Perform

Arvato SCM Solutions offers supply chain management and beyond. Our focus is on consumer-oriented industries such as automotive, banking and insurance, consumer goods (FMCG) and fashion, healthcare, high-tech and entertainment, publishers and telecommunications. For all of these sectors, we provide tailor-made, sustainable and innovative solutions that meet the individual needs of our clients and enable them growth and transformation.

eWith over 55 distribution hubs in Europe, Russia, Asia and the US, Arvato SCM Solutions provides the necessary scalability, flexibility and experience to give their customers the decisive competitive edge.

Whatever you need – we find the solution. Our industry specialists, more than 14,000 employees worldwide, and not least our passion to keep inspiring our clients and their customers, will ensure your success.

WBR Insights conducts industry research and create executive-level content in e-commerce, Procurement, Supply-Chain, and Finance. Find out what your audience are saying.

For more information visit: www.digitaleu.wbresearch.com